An Opportunity to Own a Piece of a Lucrative On-Chain “Decentralized Central” Bank

Luminous Ledger Newsletter Issue #1

Fiat money — the biggest adversary of prosperity.

It’s one of the reasons why we’re huge cryptocurrency proponents.

And that has served us very, very well.

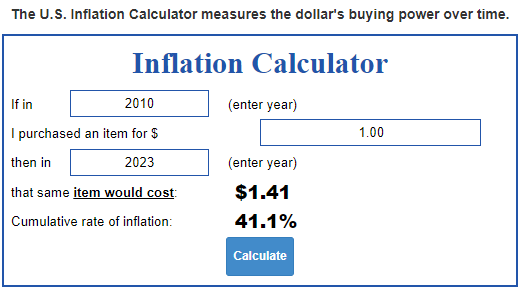

Since bitcoin started trading in 2010, the U.S. dollar’s purchasing power is down 41.1%, while bitcoin relative to the U.S. dollar is up 3,816,140,000% based on prices at the time of writing.

This is not to say that we were so early to bitcoin that we were able to partake in those astonishing gains. It’s just to say that over any long enough timeframe, bitcoin has outperformed the U.S. dollar and any other prominent inflation hedges such as bonds, stocks, and real estate.

Furthermore, the figures above compare bitcoin to the strongest, most resilient fiat money in the world, the U.S. dollar.

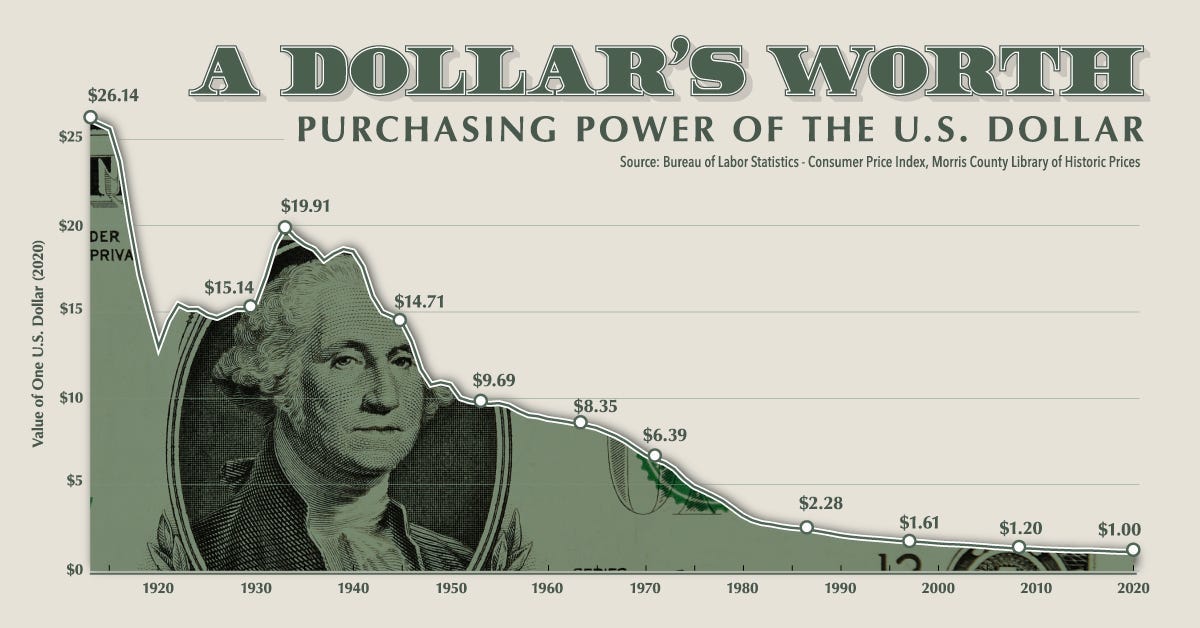

The same dollar that has suffered the fate of money debasement like all the empires — from the Roman to the Ottoman.

But this debasement, in the eyes of other fiat money, seems like mere fluctuations.

Such is the reality of other fiat money.

The Argentinian peso is one such example, as seen below.

But talking about inflation isn’t the goal here — the goal is to understand why economies like Argentina, which are experiencing rampant hyperinflation, are planning to dollarise their economies.

The newly elected president of Argentina, Javier Milei, already has plans to dollarise the economy.

But as we pointed out above, the dollar is also inflating away its value, albeit not as dramatically as, say, the Argentinian Peso.

So why is the U.S Dollar, with its forthcoming doom of debasement like all other fiat currencies, held in such high regard by the rest of the world, especially those looking to escape the disease of hyperinflation?

Sure, it holds the status as the most resilient currency. And yes, it has sheer amounts of network effects and liquidity. It also powers the largest economy in the world. But most importantly, the U.S. dollar is protected by the threat of violence from the largest, most powerful military in the world.

But, as we know, there’s a new kid on the block — and it’s only a matter of time before people flock to him.

“The fact that the U.S. debt just topped $30 trillion and the fact that they need to pay a meagre sum of the entire bitcoin market capitalisation as their yearly interest payment while the Secretary of the U.S. Treasury is saying this really puts the dire situation of the U.S. dollar in perspective.” ~imajinl, in his latest blog post

The holy grail of fiat, the U.S. dollar, is like the prettiest cow on its way to the slaughterhouse.

It will eventually suffer the fate of all the fiat money in history, but it will be the last to do so.

But where are we going with all this?

On the one hand, we’re praising the U.S. dollar for being capable of replacing hyperinflating fiat, but on the other hand, foreshadowing its eventual collapse.

What if I told you — yes, you — that there’s a way to profit from the U.S. dollar’s power in the short term, and when the dollar, like its other fiat counterparts, eventually collapses, profit off of the future of money?

In the real world, this is obviously not possible.

In crypto, however, it's a completely different story.

All Roads Lead to Frax Finance

Just to be clear, we don’t see the U.S. dollar collapsing any time soon; in fact, it’s only growing in its global dominance.

In places experiencing hyperinflation or alike, being able to store one's monetary value in U.S dollars is a god-send. Alas, holding/acquiring U.S Dollars is normally illegal or very hard to do.

Enter U.S dollar pegged (equivalent) stablecoins.

Ever wonder why $USDT (a U.S. dollar stablecoin on the blockchain) is so used on the Tron blockchain in places like Argentina where, before Milei, excessive capital controls were placed on those holding or wanting to hold U.S. dollars?

Now you know.

We believe that capital controls in places with hyperinflation are futile in a world with permissionless blockchains that allow for tokenized assets (like U.S. dollar stablecoins), for these stablecoins on the blockchain are the way for people in these places to stop hyperinflation from completely eating away their savings, and transact with one another without any controls by the government.

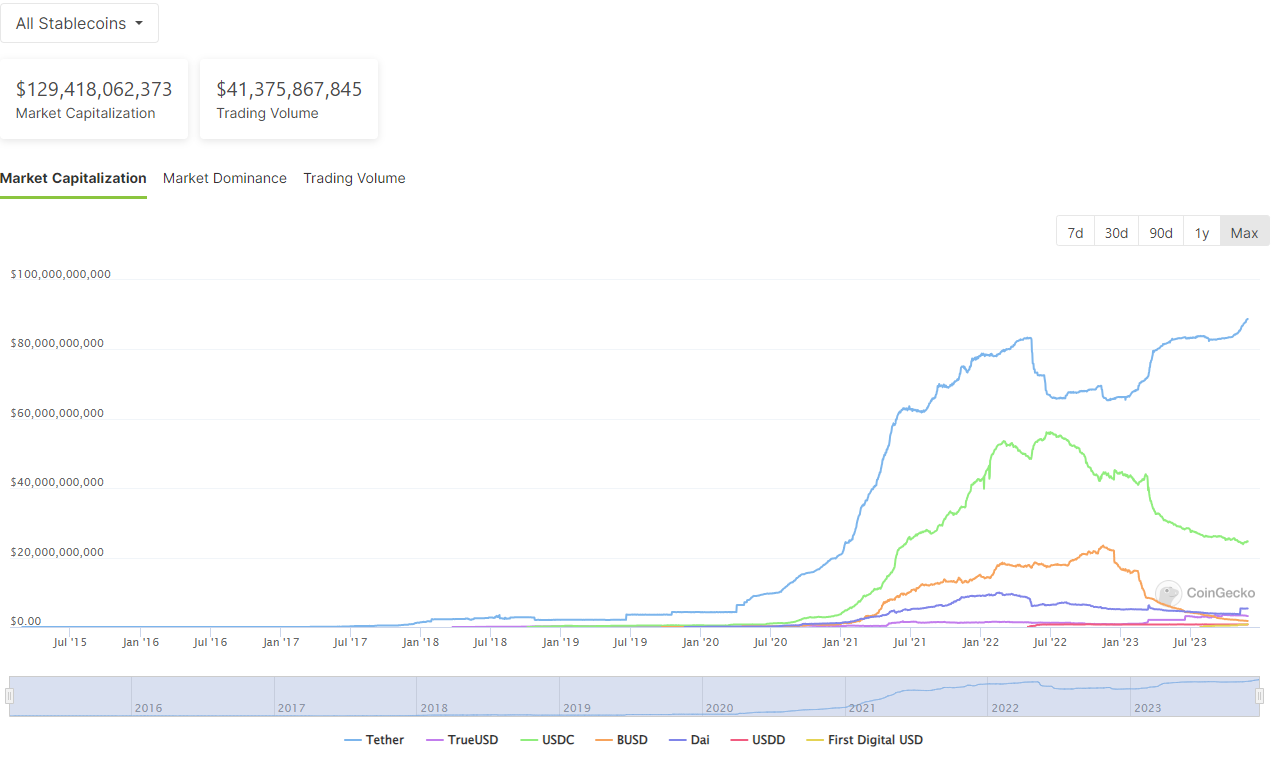

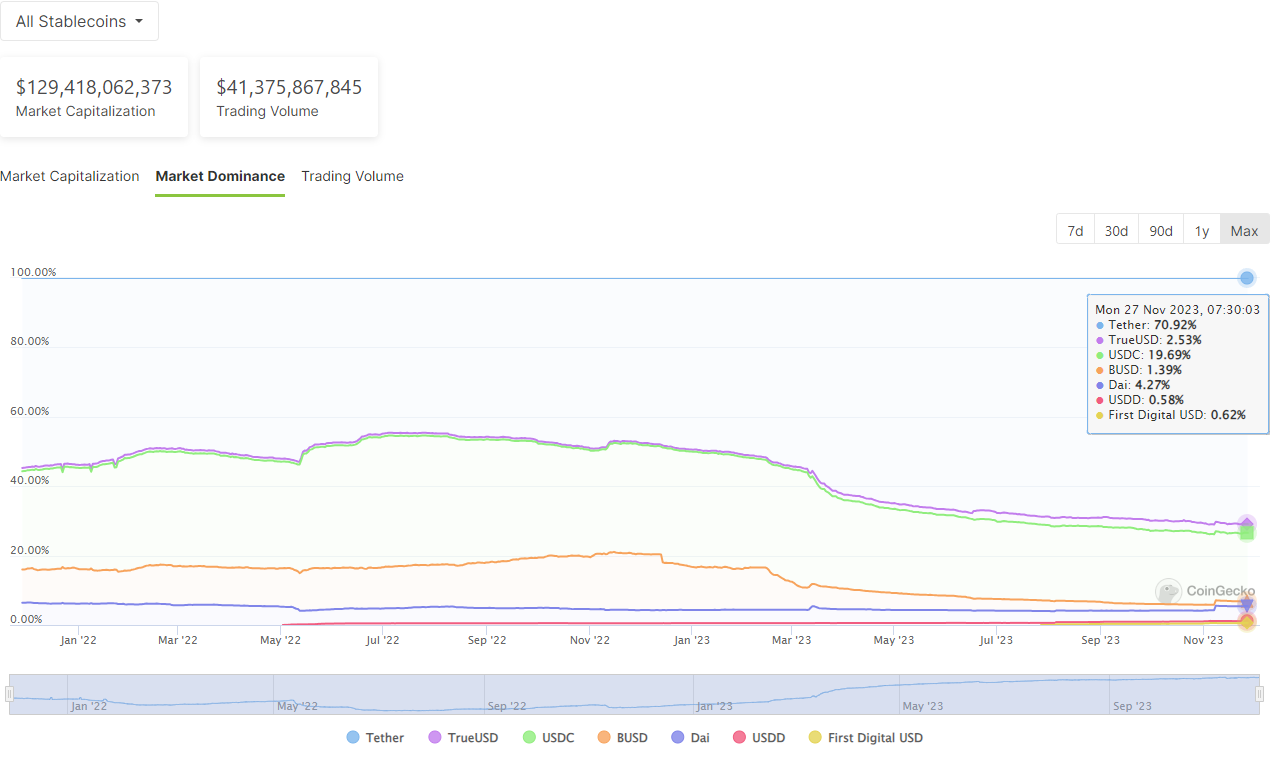

The cryptocurrency market clearly reflects this, with U.S. dollar stablecoins comprising $129 billion of the whole cryptocurrency market capitalisation, as can be seen below.

The problem, as mentioned above, is that the U.S. dollar too, is inflating away, albeit in increments.

And if you hold something like $USDT or $USDC, you have no choice but to accept that and move on with life.

Currently, in the U.S., you can earn upwards of 5% interest on your U.S. dollars by buying treasury securities or other instruments with very low risk, which is a good way to hedge against or even outpace/outperform inflation.

But for people in adverse conditions (or even DAOs or crypto organizations) holding $USDT and $USDC this is not an option as with these stablecoins they simply can’t tap into this yield.

And that, my friends, is one of the main issues Frax Finance is solving.

Some key tenets that a stablecoin of this nature has to have are:

Stability; a stablecoin should be as rock solid and reliable as possible.

Deep liquidity; a stablecoin should be as liquid as possible so as to permit easy entry/exit and stability.

Sustainability/profitability; a stablecoin should be able to capture value to remain sustainable — one way that Frax is achieving this is via multiple strong revenue generation streams.

Without further ado, let’s dive into Frax Finance and its myriad of products that collectively aim to solve this problem. The astute reader will notice that each of Frax Finance’s product offerings are aimed at one or multiple of these tenets.

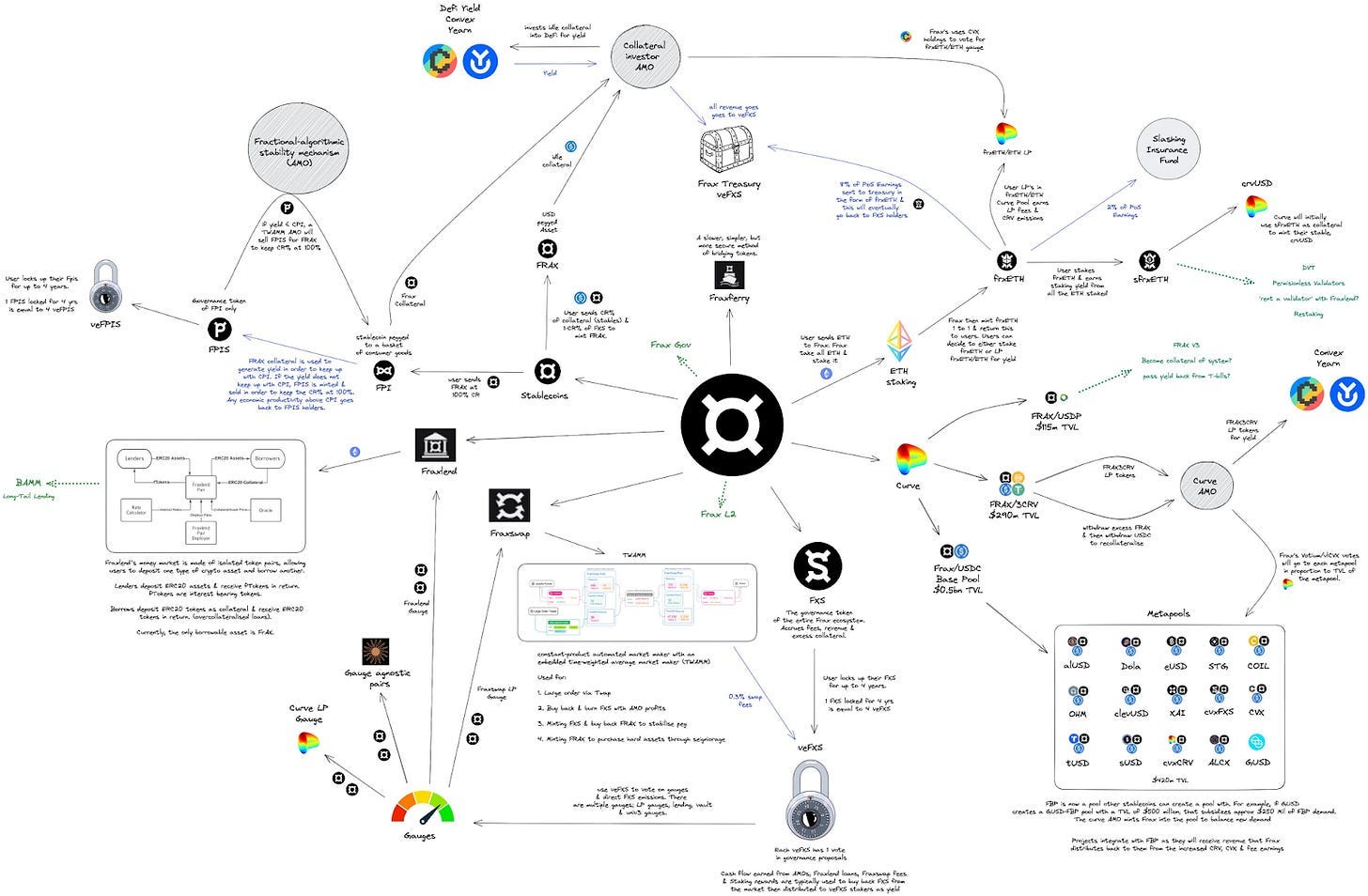

Frax Finance — The Stablecoin Protocol

A good description of Frax Finance is that of a stablecoin protocol — wherein a stablecoin is a token on the blockchain pegged to an asset, i.e., a derivative or synthetic token of sorts.

We will be covering Frax Finance’s stablecoin offerings including $FRAX, $FPI, $frxETH and the robust ecosystem that backs them, so let’s break it down step-by-step.

$FRAX, the U.S. Dollar Stablecoin

One of Frax Finance’s flagship products is their U.S. dollar equivalent/pegged stablecoin called $FRAX.

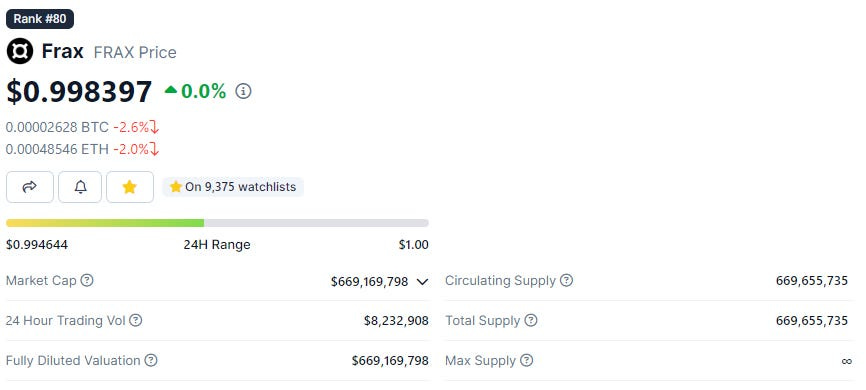

Already reaching impressive feats, such as being one of the only quasi-decentralized stablecoins to reach a market capitalisation of around $700 million, we believe $FRAX is not only a formidable competitor to the largest stablecoins today, like $USDC and $USDT, but we also believe the underlying mechanisms and resiliency of $FRAX are some of the best there are for stablecoins.

In order to understand the $FRAX stablecoin we need to take a look at a few of Frax Finance’s key implementations, namely:

Algorthmic Market Operations (AMOs)

Frax basepool (FraxBP)

Staked Frax ($sFRAX)

AMO and Peg

As we can see below, the $FRAX stablecoin has done a great job of being stable against the U.S. dollar, oscillating a few basis points to the upside and downside — which is normal for stablecoins in crypto.

$FRAX indeed depegged in March, but this was during the collapse of SVB, during which other stablecoins like $USDC also experienced turmoil. However, $FRAX quickly got back to the desired $1 peg.

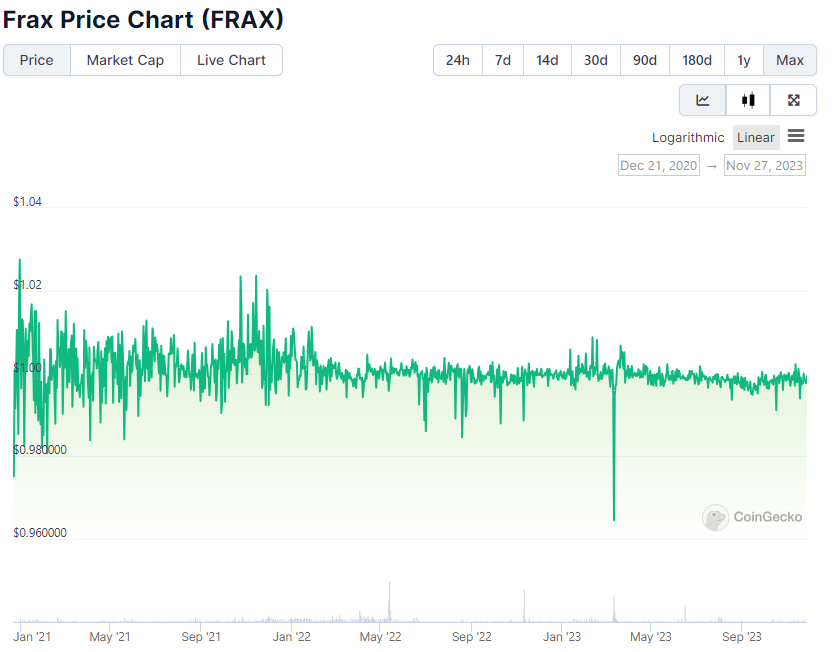

Even during the Luna $UST collapse, the $FRAX peg proved to be super resilient, as seen below.

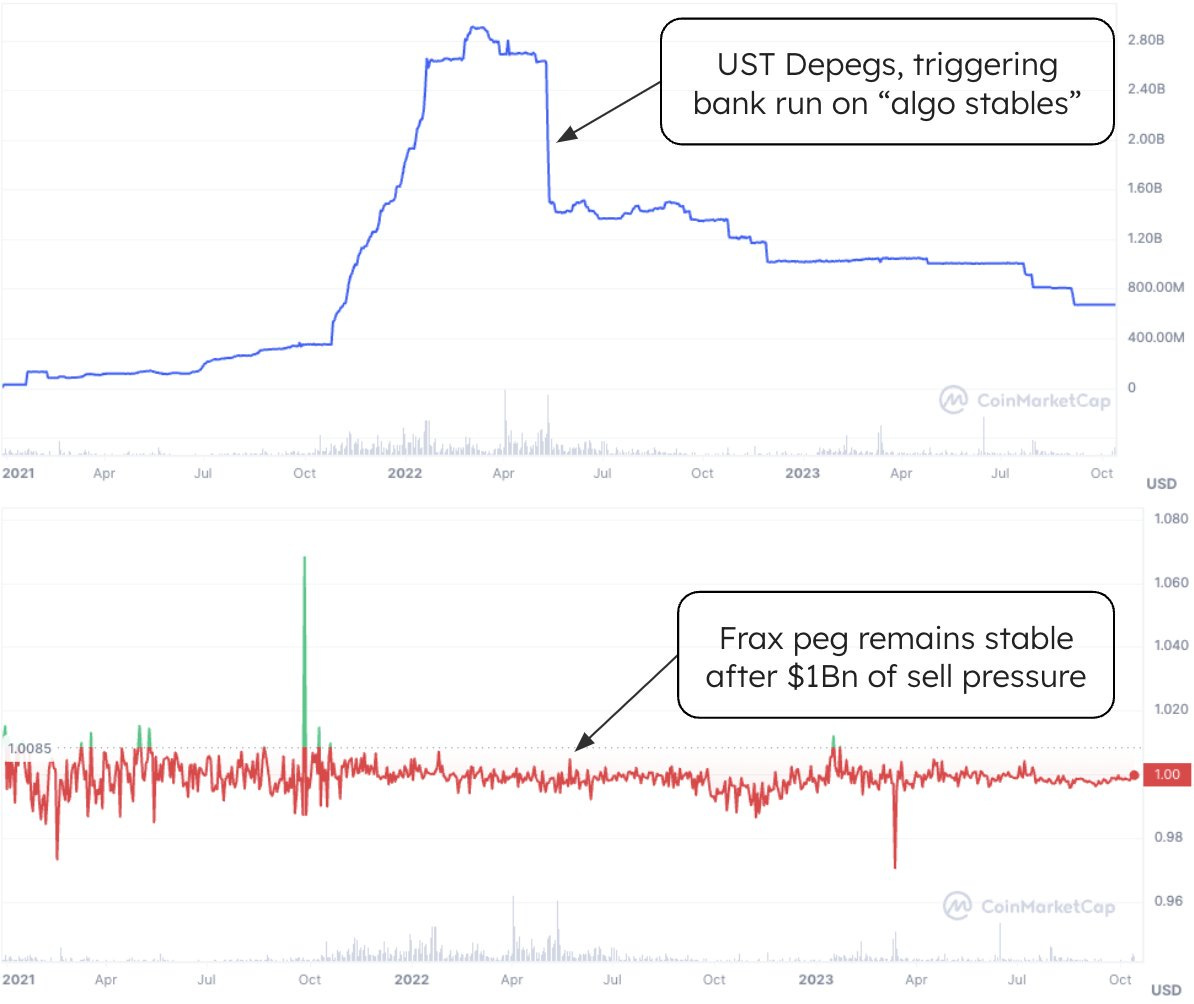

While we don’t want to bore you with all the details on how $FRAX stays at its $1 peg, which you can read more about in Frax Finance’s documentation, we do want to highlight one unique aspect of $FRAX — AMOs or algorithmic market operations, which is the main mechanism by which $FRAX maintains its $1 peg.

AMOs are basically a way for Frax Finance to generate tremendous amounts of revenue while keeping the $FRAX peg tight around $1.

How it works is as follows — a smart contract essentially calculates how much $FRAX can be sold into the open market without affecting its peg negatively and then proceeds to mint said $FRAX into on-chain liquidity pools to earn rewards like trading fees and tokens emitted to the liquidity pool (if any). Then, when the $FRAX peg looks shaky, the AMO withdraws the $FRAX liquidity it owns and burns it.

For a more in-depth explanation, I made an easy-to-understand video, which you can find below.

But what is explained in the video above is just the Curve Finance AMO (more on this below), and Frax Finance has a plethora of AMOs at its disposal, with a lot of them not necessitating selling $FRAX on the open market.

Some of these AMOs include minting $FRAX tokens against overcollateralized positions on money markets like Aave or depositing treasury assets into liquidity pools.

Essentially, Frax Finance employs many other AMOs which can mint $FRAX stablecoins into many liquidity pools, money markets (which can facilitate the borrowing of $FRAX), etc. as long as the peg isn’t broken.

While this earns profit for Frax Finance, it also increases the adoption of $FRAX, the U.S. dollar stablecoin, as it is more integrated in DeFi, as explained above.

Clever, don’t you think?

These AMO mechanisms effectively ensure that when demand for $FRAX is high, the supply will scale in tandem.

The reason being that if demand is high there will be an imbalance in the liquidity pools (more $USDC and less $FRAX, and in extreme cases this means that the value of 1 $FRAX is more than $1 due to how the Curve AMM works for stablecoins, i.e., overpeg (essentially a depeg, but not for the “worse”), and thus the AMO can go ahead and mint more $FRAX into circulation to match demand without bringing the peg below $1.

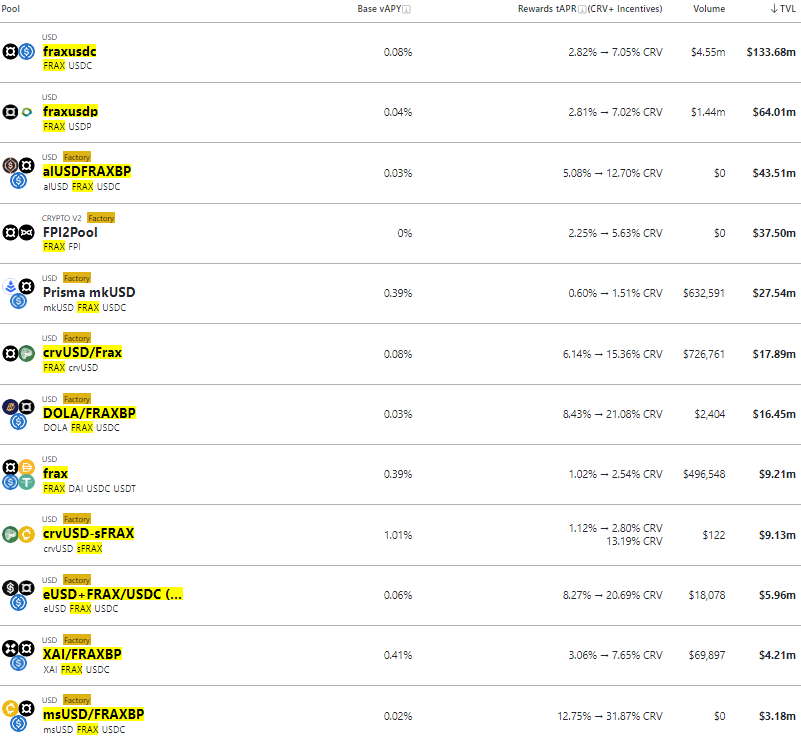

Apart from having clever mechanisms like these to generate revenue, $FRAX also has some of the deepest on-chain liquidity for a stablecoin.

Just on Curve Finance (the hub for stablecoin liquidity) alone, $FRAX has hundreds of millions in liquidity (denominated in U.S. dollars).

And a lot of these liquidity pools have very enticing incentives, to say the least.

On the main liquidity pool, called the “Frax basepool” or FraxBP for short — which is comprised of $FRAX and $USDC, users can earn a yield of around 7%, not bad for a yield that only requires stablecoin exposure!

How is this, you ask?

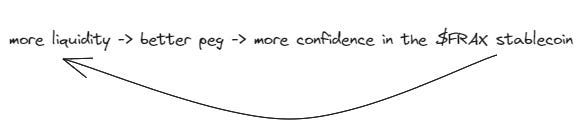

Clearly, it’s great for attracting more liquidity and enacting the flywheel below, but is it sustainable?

We’ve seen stablecoins like $UST fail drastically due to unsustainable yields, so how is this any different?

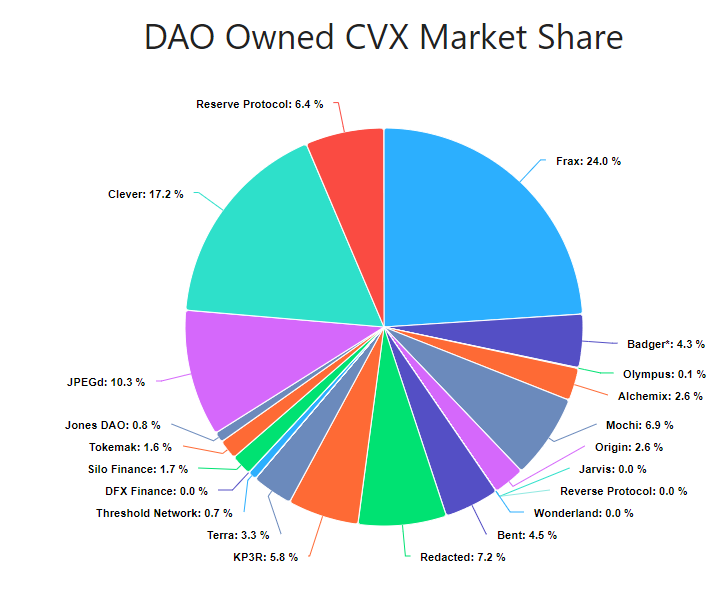

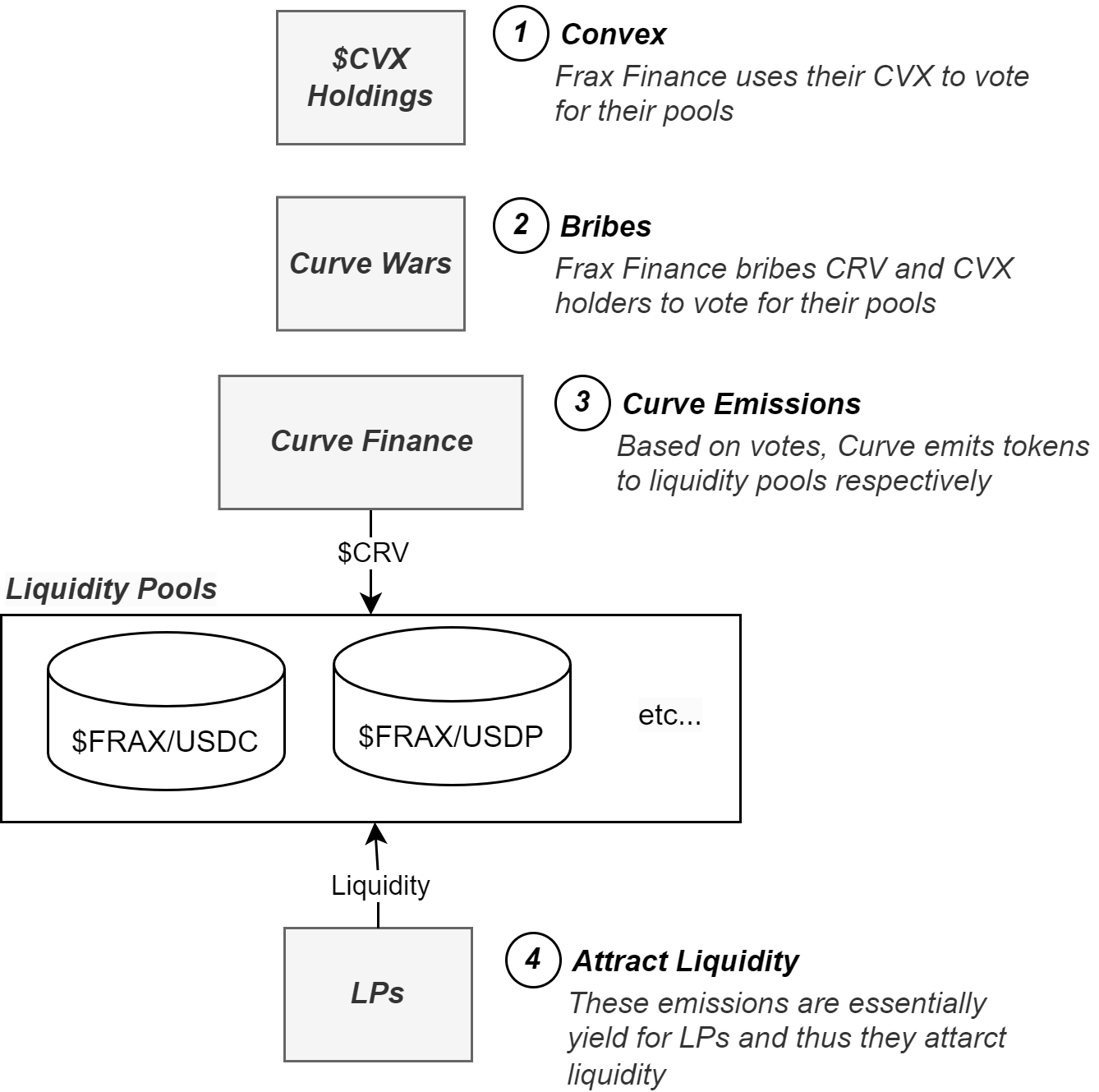

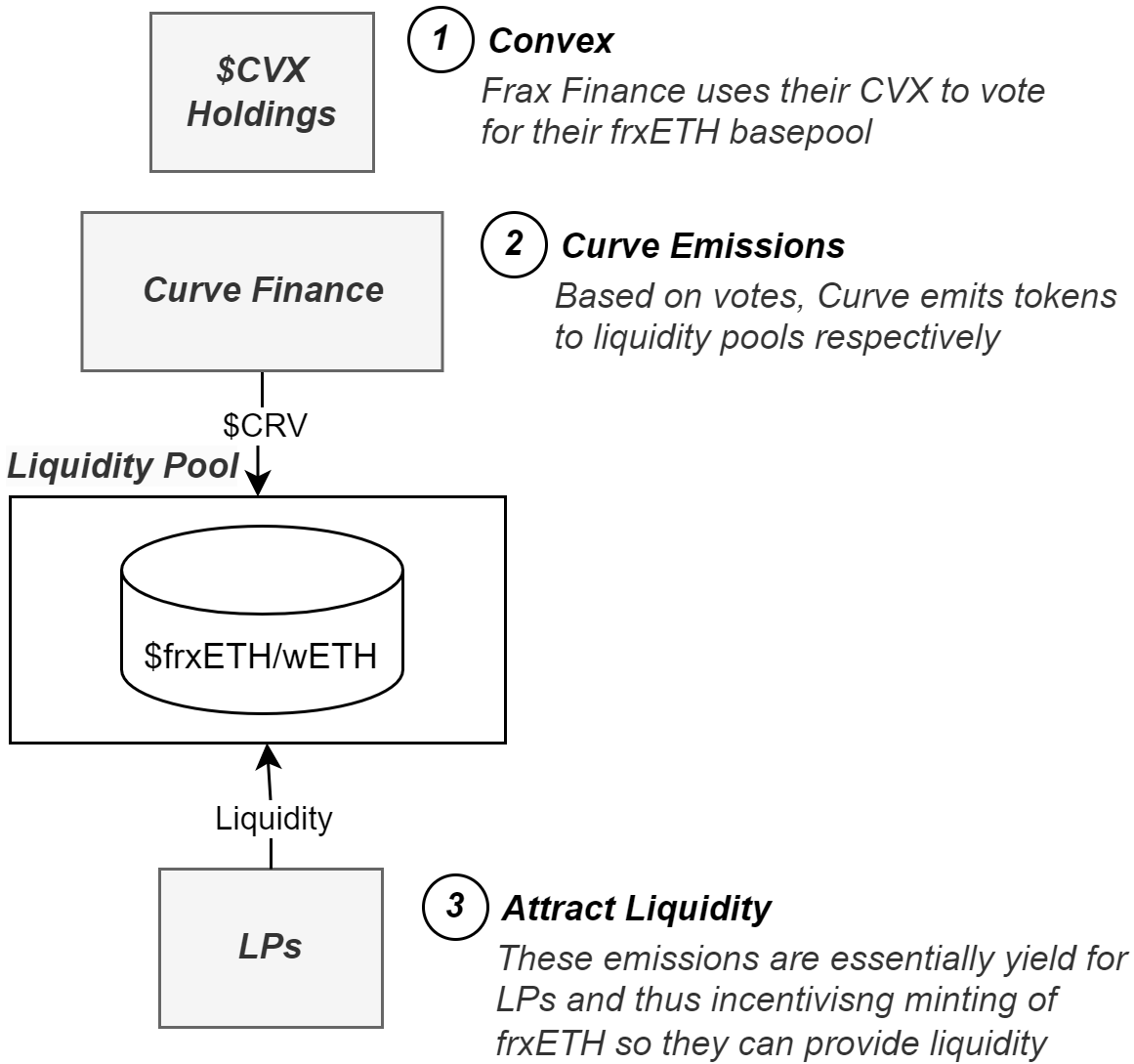

Well, Frax Finance happens to be the largest holder of $CVX, which, in turn, is the largest holder of $CRV, Curve Finance’s governance token, which carries with it the power to direct $CRV emissions to any liquidity pool, thus incentivizing liquidity provision.

They’re also active bribers in the Curve wars, which further incentivizes liquidity provision for $FRAX liquidity pools.

I know that might be a lot to take in, so we recommend reading this article to understand what’s going on.

To explain this simply, Frax Finance has essentially invested heavily in a way to get perpetual, sustainable emissions to their liquidity pools to incentivize liquidity provision.

Why is it that $FRAX has so many liquidity pools? I hear you asking.

That’s a great question, and to understand that, we’re going to have to explain the positive-sum nature of Frax Finance.

More specifically, let me introduce the concept of the FraxBP, something we’ve touched on briefly above.

Frax basepool (FraxBP)

Apart from being one of the largest stablecoin liquidity pools in crypto, $FRAX is also one of the most scalable.

Let me explain.

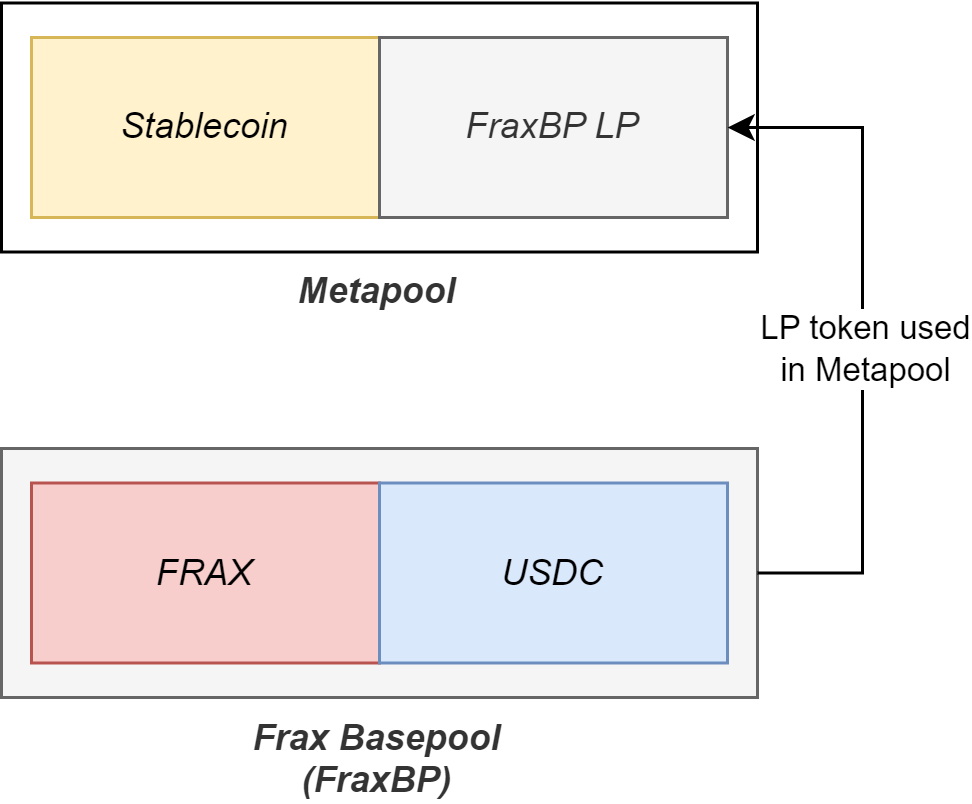

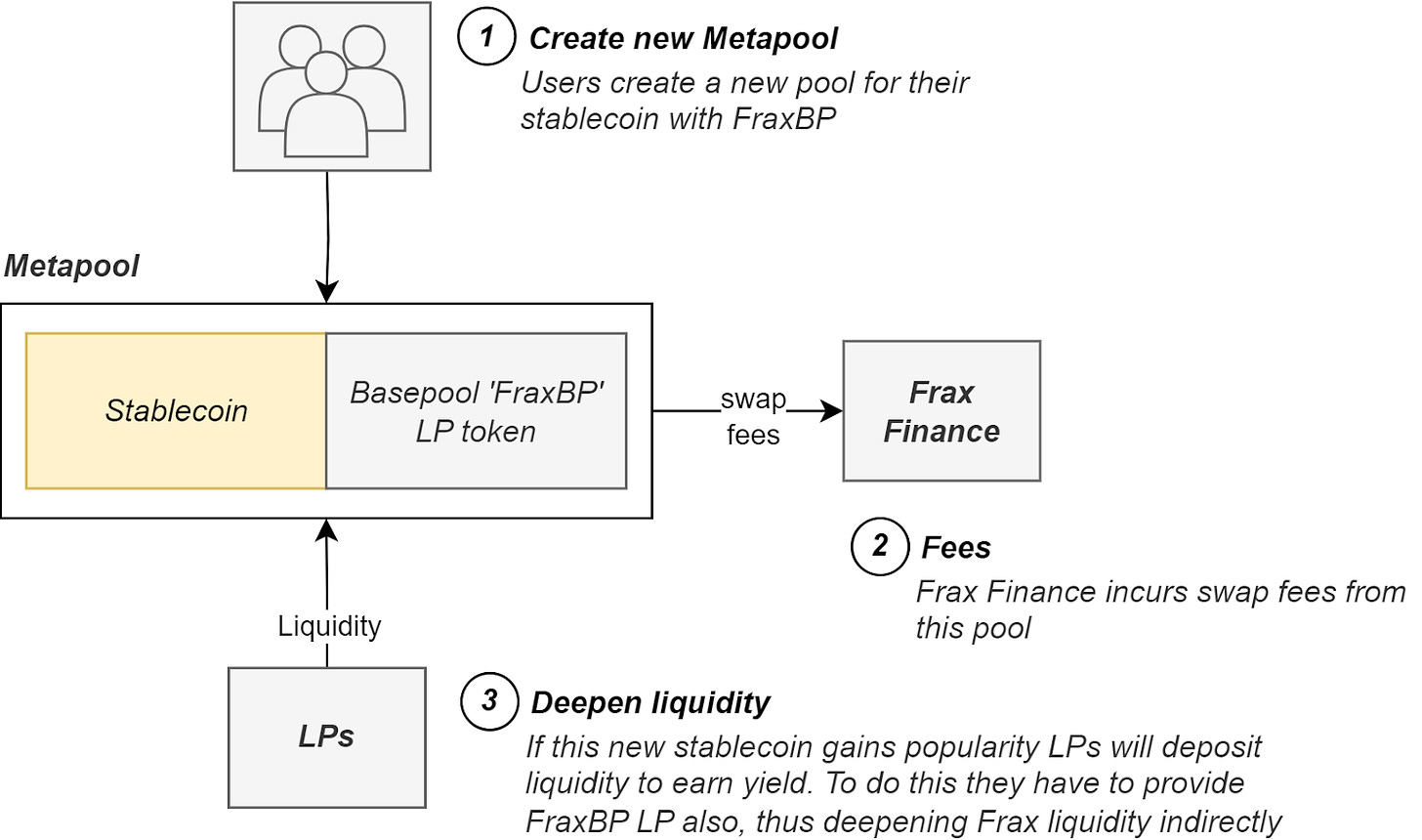

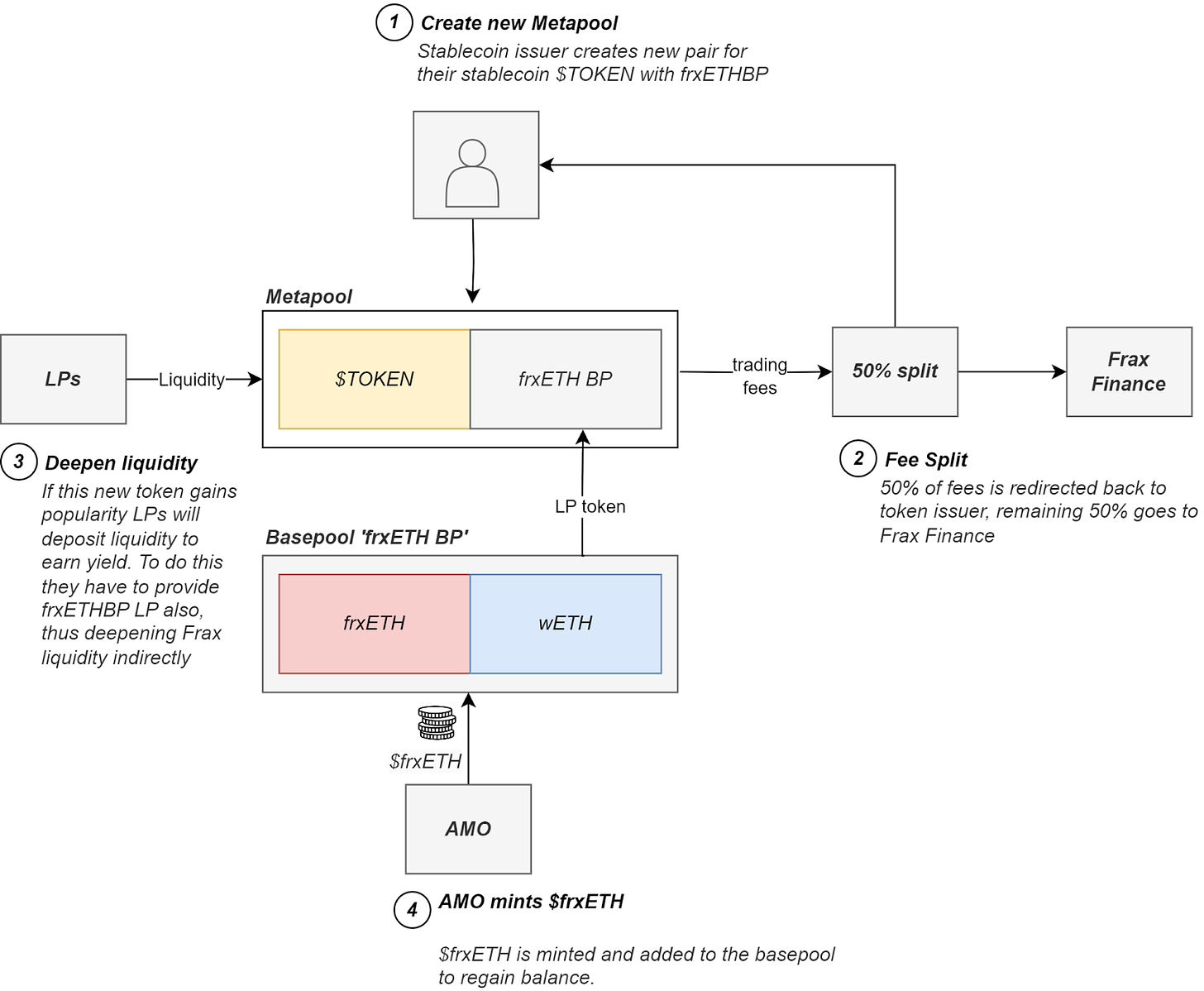

First, though, let us understand what a metapool is. A metapool is a Curve liquidity pool where a stablecoin (or some other token) is paired with the LP token from another pool, a so-called basepool.

So, essentially, if I wanted to create a liquidity pool for some stablecoin, I could do so by making a liquidity pool with this stablecoin and the Frax basepool ($FRAX+$USDC), creating a so-called metapool.

But what incentive do users have to do this, and why is this beneficial for Frax Finance?

First, if a user pairs this stablecoin with the Frax basepool, Frax Finance incurs a small swap fee even if the swap is made through this newly created pool. Second, Frax Finance deepens its liquidity, as if this newly created stablecoin attracts liquidity for its pool, it indirectly does so for Frax Finance.

The consequences of the following are as follows:

The $FRAX basepool generates more in swap fees, half of which goes to the Frax Finance protocol.

As $FRAX’s liquidity deepens, users can trade the $FRAX stablecoin with less price impact (including slippage), increasing the trading volume in $FRAX liquidity pools, hence generating the protocol more swap fees.

As $FRAX liquidity deepens, as mentioned previously, the AMO is able to mint more $FRAX tokens into liquidity pools, generating swap fees as well as extra token emissions.

It’s obviously great for Frax Finance, but why in the world would another stablecoin want to pair with this Frax basepool?

The answer: positive-sum incentive mechanisms.

Whenever another stablecoin pairs with the Frax basepool, it entitles that stablecoin to earn essentially half of what Frax Finance earned following the Frax basepool pairing with the new stablecoin.

For example, I launch a stablecoin $XYZ, and I pair it with the Frax basepool, which not only has two trusted and reputable stablecoins constituting it, but also some of the deepest liquidity.

This pairing generates $10,000 in revenue for Frax Finance it would not otherwise have (through mechanisms elucidated above). Consequently, half of this revenue is entitled to Frax Finance and the other half I (as the $XYZ stablecoin issuer) get to keep.

So both parties essentially benefit from the other — positive-sum.

This is a simplification of the mechanisms at hand, but it should give you a picture of the positive-sum games Frax Finance loves to play.

For further information on this, you can peruse this governance proposal.

Staked Frax ($sFRAX)

As mentioned before, $USDT and $USDC holders have no choice but to eat the inflation the U.S. dollar is facing.

Keep in mind that these are the two largest stablecoins, together accounting for most (90%+) of the stablecoin market capitalisation.

We can see how many of these stablecoin holders are missing out on the aforementioned juicy yield, upwards of 5% interest on U.S. dollars.

Sure, with $USDC and $USDT you still get permissionless access to the holy grail of fiat, the U.S. dollar, but wouldn’t it be nice to go step one further and earn that juicy yield?

This is exactly what staked $FRAX ($sFRAX) aims to do.

$sFRAX, in a nutshell, is yield-bearing U.S. dollars. You acquire $sFRAX by staking $FRAX stablecoins.

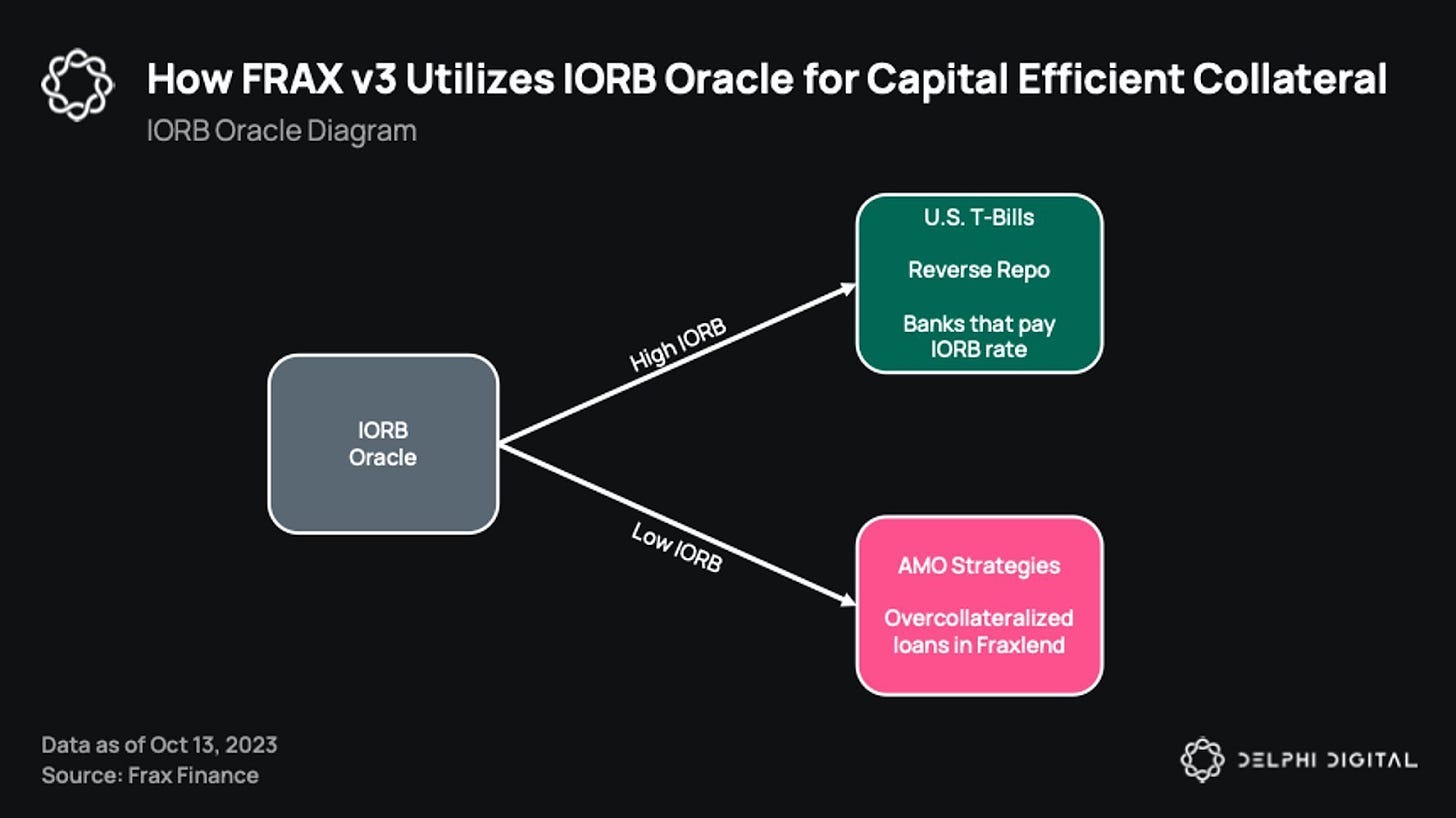

The $sFRAX yield attempts to track the interest on reserve balances (IORB) rate of the United States Federal Reserve using an oracle. This IORB rate is generally held as the “risk-free-rate” of the U.S. Dollar and is essentially earned by depositing U.S. Dollars at the Federal Reserve.

But didn’t MakerDAO recently introduce a way for its U.S. dollar stablecoin ($DAI) holders to accrue yield from real-world treasury securities (bills, to be more precise) by depositing their $DAI tokens into a contract known as the DSR (DAI savings rate)?

How is $sFRAX different?

First and foremost, $sFRAX earns the IORB rate and doesn’t need to buy treasury securities like MakerDAO to accrue yield to holders. This is beneficial as there is no risk of illiquidity, as the IORB rate is earned on U.S. dollar deposits at the Federal Reserve, while bonds may need to be sold, which may incur losses due to unfavorable execution or adverse market conditions or low liquidity.

Second, the $sFRAX yield will almost always be higher than the DSR yield. This is because $sFRAX will utilise the highest yielding instruments (RWAs like short-term U.S. treasury bills, U.S. dollar deposits at Federal Reserve master accounts, Federal Reserve overnight repurchase agreements, and selected money market mutual fund shares) instead of relying merely on the IORB rate.

This way, $sFRAX can move funds around to optimize for the highest-yielding instrument.

Furthermore, if Frax Finance’s AMOs can find venues to earn a yield higher than its RWA counterpart, staked $FRAX can be allocated towards it.

MakerDAO’s DSR, however, is always going to be subject to real-world rates to earn a yield, while staked $FRAX can utilise the best of real-world rates and even on-chain rates (yield) to deliver to $FRAX stakers.

As if that wasn’t enough, $sFRAX also has zero — yes, zero — fees that stream to Frax Finance protocol.

You might be thinking — “that’s great for the users of the product but bearish for the protocol.”

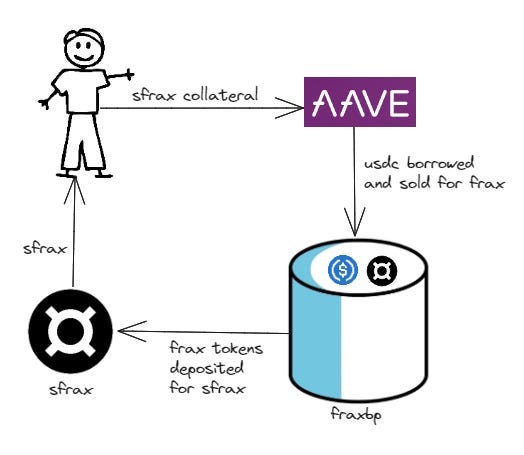

While that is indeed a sound line of reasoning, it is prudent to remember the fact that as the demand for $FRAX increases, it allows the AMO to mint more $FRAX into liquidity pools, in turn increasing revenue, as explained before. This is amplified considering the fact that users might even want to leverage up on their $sFRAX position, as depicted in the image below.

We can clearly see how $sFRAX is a superior product and can also start to see why $FRAX is a formidable competitor to the largest stablecoins today, like $USDC, $USDT, and $DAI.

In a nutshell, $sFRAX delivers yield to stakers of the stablecoin, unlike $USDT and $USDC, and is a superior product to $sDAI.

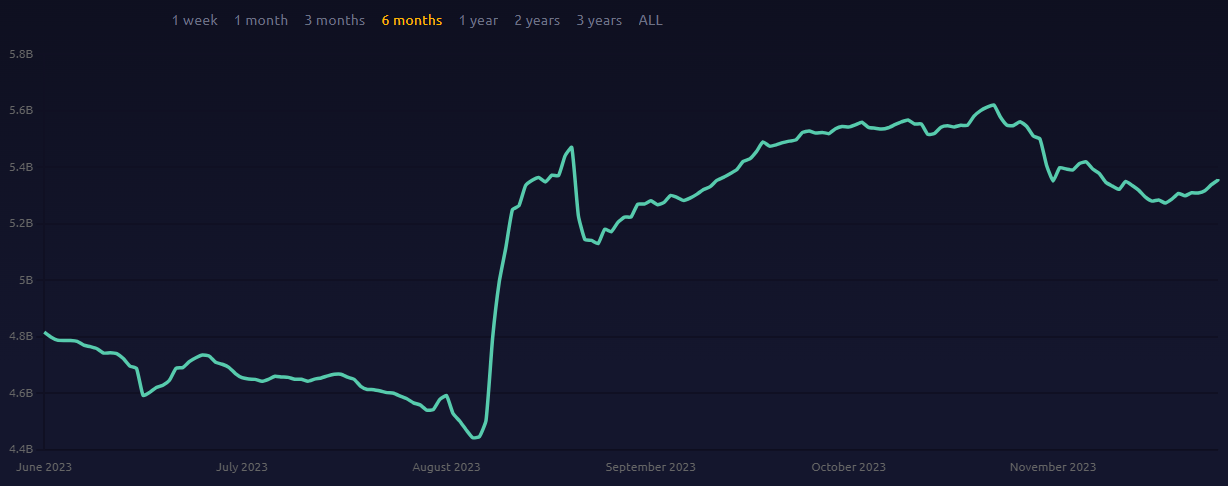

As seen in the image above, $DAI’s supply (i.e., market capitalisation, as $DAI is pegged to the U.S. dollar) has grown since the first half of this year, which can be mostly attributed to the fact that the DSR started delivering substantial (5-10% APY) returns on $DAI. Essentially showcasing the demand that exists for a stablecoin that generates a sustainable yield.

This trend is contrary to $USDC’s, whose supply has been trending downwards in the same timeframe, as holders switch to stablecoins that can deliver yield to them.

Using the aforementioned logic and rationale, as well as the analytics that back them, we can see that the demand for the $FRAX stablecoin is ripe to materialise, considering $sFRAX launched just around a month and a half ago.

It is also important to note that we envisage DeFi, and by extension, Frax Finance empowering individuals not only in areas of economic turmoil to access on-chain U.S. dollars and yield, but also allowing for them to amplify their yields due to the composable nature of smart contracts.

For an in-depth explanation of all the types of composability in DeFi, I recommend reading this article by MoonPay and this article by Monolith, as well as watching the video below to further conceptualise the concept with more applications.

$FRAX’s Integrations

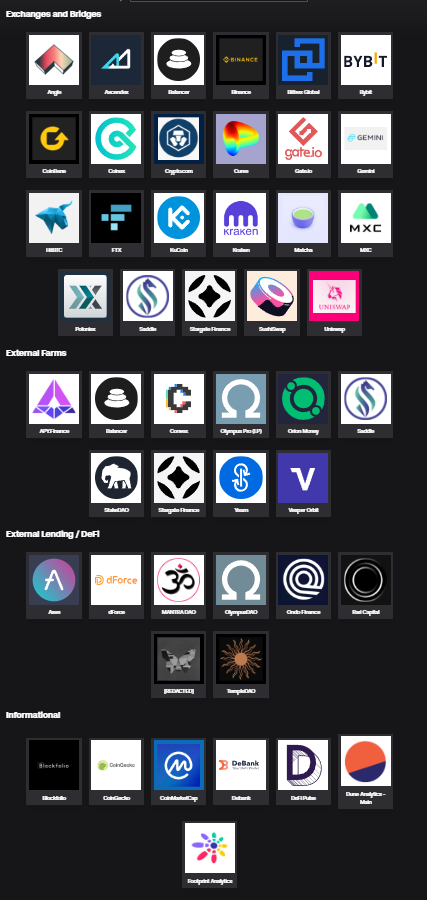

We have already covered the use case $FRAX is going for, but to add onto that, $FRAX also boasts a myriad of integrations on-chain, as seen below.

These integrations not only lead to an increased demand for $FRAX, but are also a testament as to how deeply embedded $FRAX is in the DeFi realm of today.

It’s important to note that $FRAX is cross-chain, i.e., lives on many blockchains, not just Ethereum — this is made possible through Frax Finance’s bridge, which we’ll get into later.

To see $FRAX’s integrations on blockchains other than Ethereum, of which there any many, refer to this.

$FPI, the U.S. Dollar Inflation Resistant Stablecoin

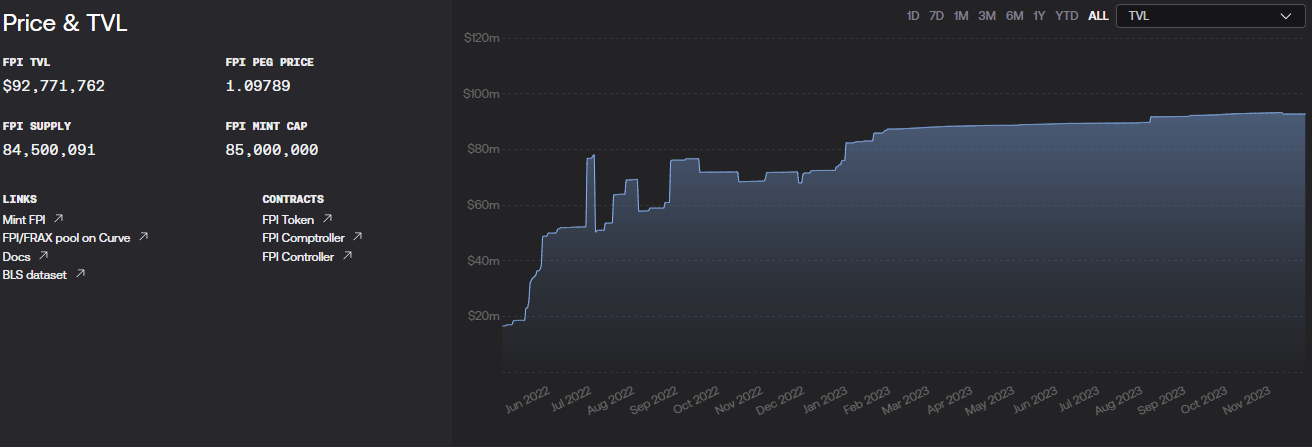

Another one of Frax Finance’s products, is their U.S. dollar inflation resistant stablecoin called $FPI (Frax Price Index).

It has already attracted around $100 million in deposits, and it doesn’t look like this trend will stop anytime soon.

On a high-level, it works by tracking the CPI (Consumer Price Index), a measure of the U.S. dollar’s inflation.

We won’t get into the details of this stablecoin, since we believe it is not at the core of Frax Finance’s value proposition at the current moment in time, since Frax Finance offers, as mentioned above, other means of protecting its users from inflation.

If you’re interested in the details of $FPI, its inner workings, and use cases, we recommend you read the respective documentation here, and watch the video below.

$frxETH, the Ether Stablecoin

So far, we have well understood the strides Frax Finance is taking to profit from the U.S. dollar’s power in the short term, but we also proclaimed that when (not if) it collapses, it will profit from the future of money.

What if I told you — yes, you — that there’s a way to profit from the U.S. dollar’s power in the short-term and when the dollar, like its other fiat counterparts, eventually collapses, profit off the future of money. ~imajinl, earlier in this issue

Welcome to the Ether.

We strongly believe $ETH, (Ether), which is the money that powers the Ethereum blockchain, will arise as one of the dominant forms of money in the coming years.

We will be sending out another Luminous Ledger issue soon elucidating why we think this is.

But what does Frax Finance have to do with it?

Ethereum’s consensus model, called Proof of Stake (PoS), is a way for $ETH holders to commit (lock up) their $ETH stake to the network in order to participate in consensus and earn rewards (tips from users, MEV, and $ETH issuance).

What is Proof of Stake? How it works (Animated) + Ethereum 2.0 Upgrade!

However, this process of locking up your $ETH means accepting some illiquidity.

This means that you can’t sell your $ETH stake at any time you want, and you also sacrifice composability, as when $ETH is staked, it becomes locked in the staking contract, rendering it illiquid and unusable in DeFi applications.

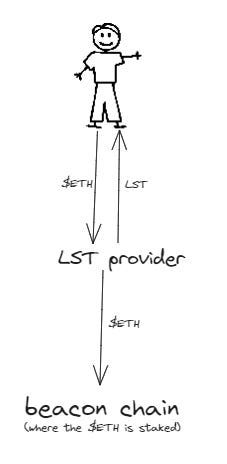

This is where LSDs/LSTs (Liquid Staking Derivatives/Tokens — usually referred to as LSTs, due to regulatory attention that the word “derivatives” attracts) come in.

Projects offer liquid staking tokens for Ethereum staking in order to allow for composability and instant liquidity.

These projects are also usually experts in staking, from the infrastructure used to stake to extracting the maximal rewards like through MEV, as well as ensuring all protocol consensus rules are followed to minimize the chances of slashing — allowing users to outsource the technical know-how and effort required to safely and profitably stake $ETH.

Furthermore, if you want to stake $ETH on your own, you need a significant holding of 32 $ETH, which is not feasible for most — which is, again, where LSTs come in.

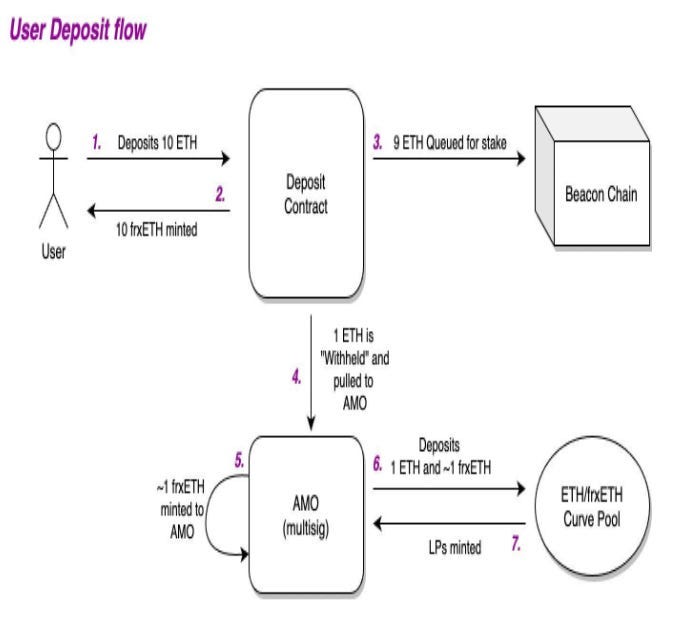

Essentially, the above is the design architecture that liquid staking token providers follow.

They take in $ETH from users, issue a corresponding $ETH LST, and then stake the underlying $ETH from users on the beacon chain, where the staked $ETH resides to earn rewards.

This stake is used to earn $ETH issuance, i.e., inflation, tips from users, as well as MEV, in some cases (more on this later).

These earned rewards accrue in $ETH, and each LST’s claim on the underlying staked $ETH and the accrued $ETH rewards increases over time, i.e., each LST is worth more $ETH over time.

Apart from being liquid, these LSTs also allow for composability within DeFi.

For example, lend your LST on Aave and borrow $USDC, or provide liquidity for LST pools.

We can clearly see why it is that LSTs provide immense value to $ETH holders.

Currently, around 24% of all $ETH in circulation is staked, with only half of the current stake going through LST providers.

One of the reasons only 24% of all $ETH is staked is because Ethereum only recently migrated to PoS and even more recently enabled people to withdraw their $ETH from the beacon chain.

We expect these numbers to increase significantly over this cycle, and with that comes an increase in demand for LSTs.

There are many, many LSTs on the market, but we believe Frax Finance, with its $ETH LST, known as $frxETH, will prevail and capture a significant portion of the LST market.

Let us explain why.

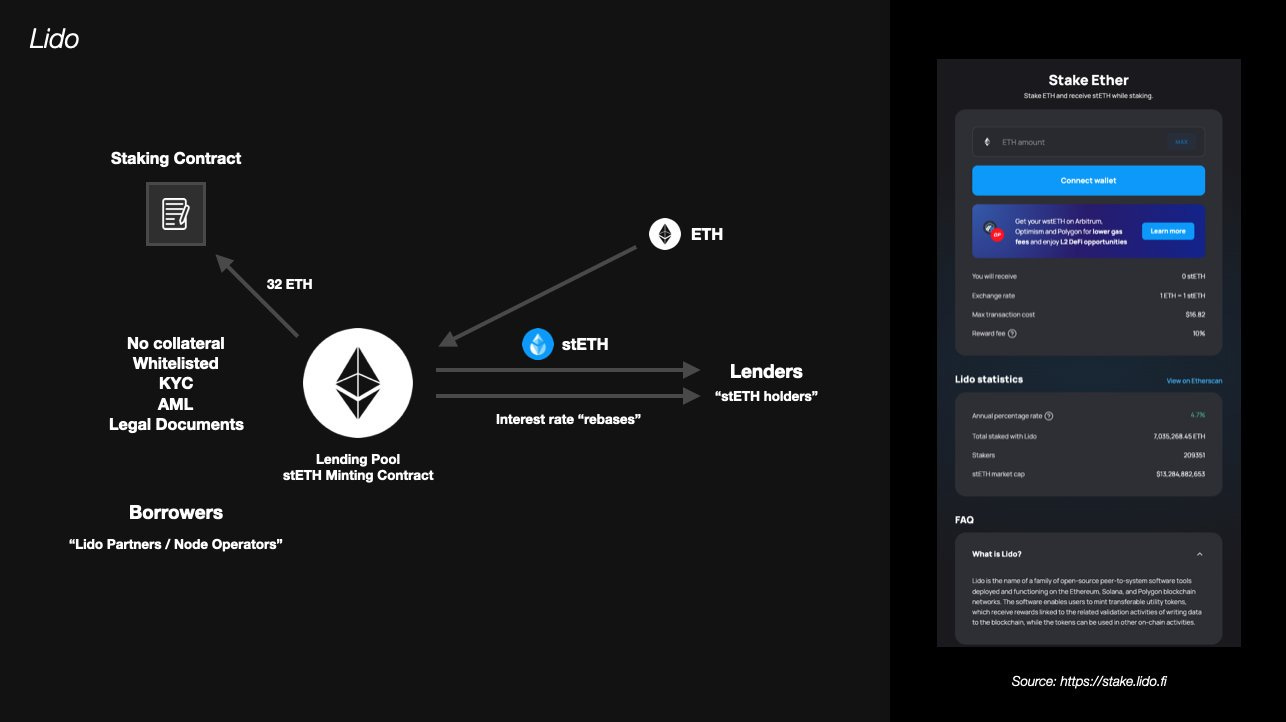

First, though, let’s look at the most significant competition Frax Finance faces — Lido, which is the most dominant and Rocket Pool.

As can be seen in the image above, Lido takes in $ETH from users, and issues stETH that rebases, i.e., increases in quantity, but users can wrap this stETH for wstETH so they can hold an interest-bearing token (a token that doesn’t increase in quantity, but underlying value denominated, in this case, in $ETH) and use it in DeFi as collateral, provide liquidity for it, etc.

Lido then takes this $ETH and gives it to their whitelisted professional node operators (of which there are 35 currently) to stake on the beacon chain and accrue yield that goes to users that are staked with Lido.

There are obviously nuances here and it’s much more technical than depicted, so referring to Lido’s documentation is prudent to get a better understanding, but in essence, the above is how it works.

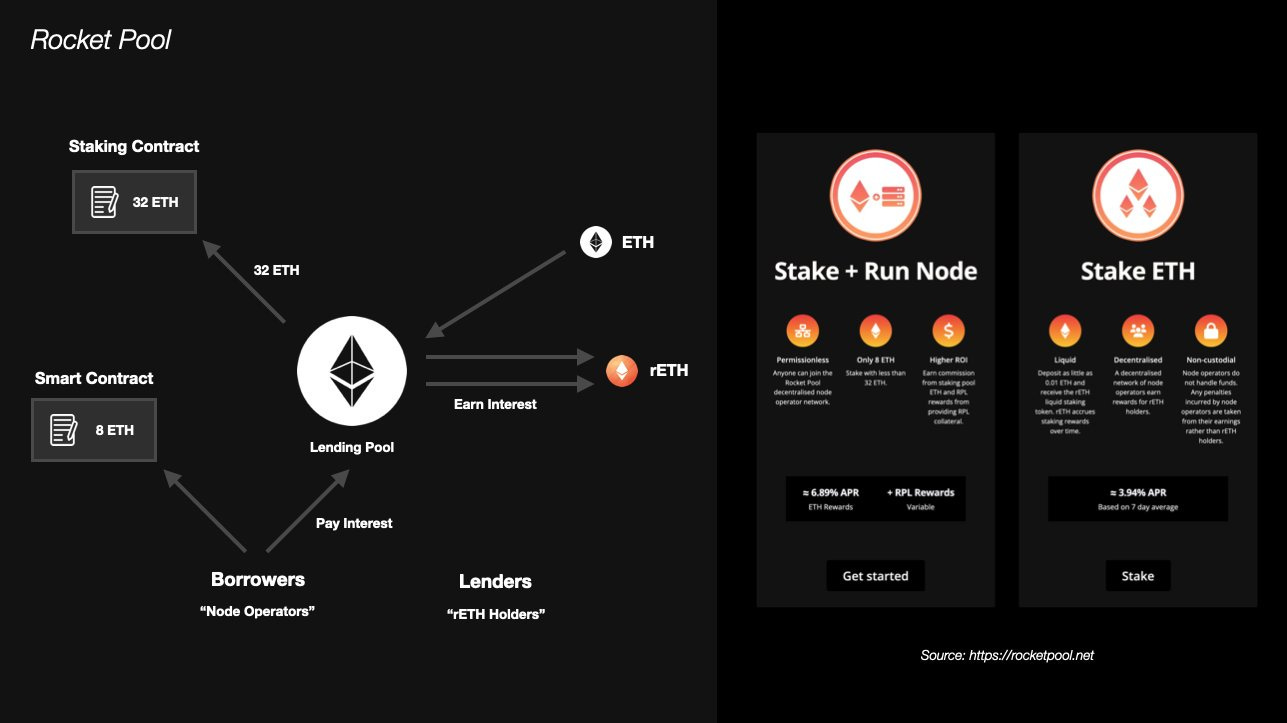

Rocket Pool isn’t much different from Lido.

The only significant difference is that Rocket Pool issues $rETH which is inherently interest bearing (you don’t need to wrap the token issued by the LST protocol), and the underlying $ETH is staked permissionlessly by any validator instead relying on whitelisted node operators like Lido.

While, from the looks of it, it’s a better design than Lido since it’s objectively more decentralized, it comes with it the disadvantage of accruing a lower yield to stakers.

Why?

Because Rocket Pool node operators need to put up 8-16 $ETH and some $RPL (Rocket Pool’s governance token) as collateral to be eligible to run the node.

This is due to the fact that these entities (node operators) are usually anonymous and not whitelisted, so stronger guarantees need to be present in order for the protocol to stay solvent and safe all times — hence the collateral.

Hence, due to this collateral requirement, node operators need to be compensated with more fees, which are taken from users.

This is why Rocket Pool delivers lower yield to stakers than incumbents like Lido.

Again, there are obviously nuances here and it’s much more technical than depicted, so I encourage you to refer to Rocket Pool’s documentation to get a better understanding, but, on a high level, the above is effectively how it works and the different design choices it has.

Enter what we believe to be Frax Finance’s most innovative product, with the most upside — $frxETH or Frax Ether.

$frxETH is Frax Finance’s LST, and it is miles ahead of its LST incumbents.

Allow us to explain.

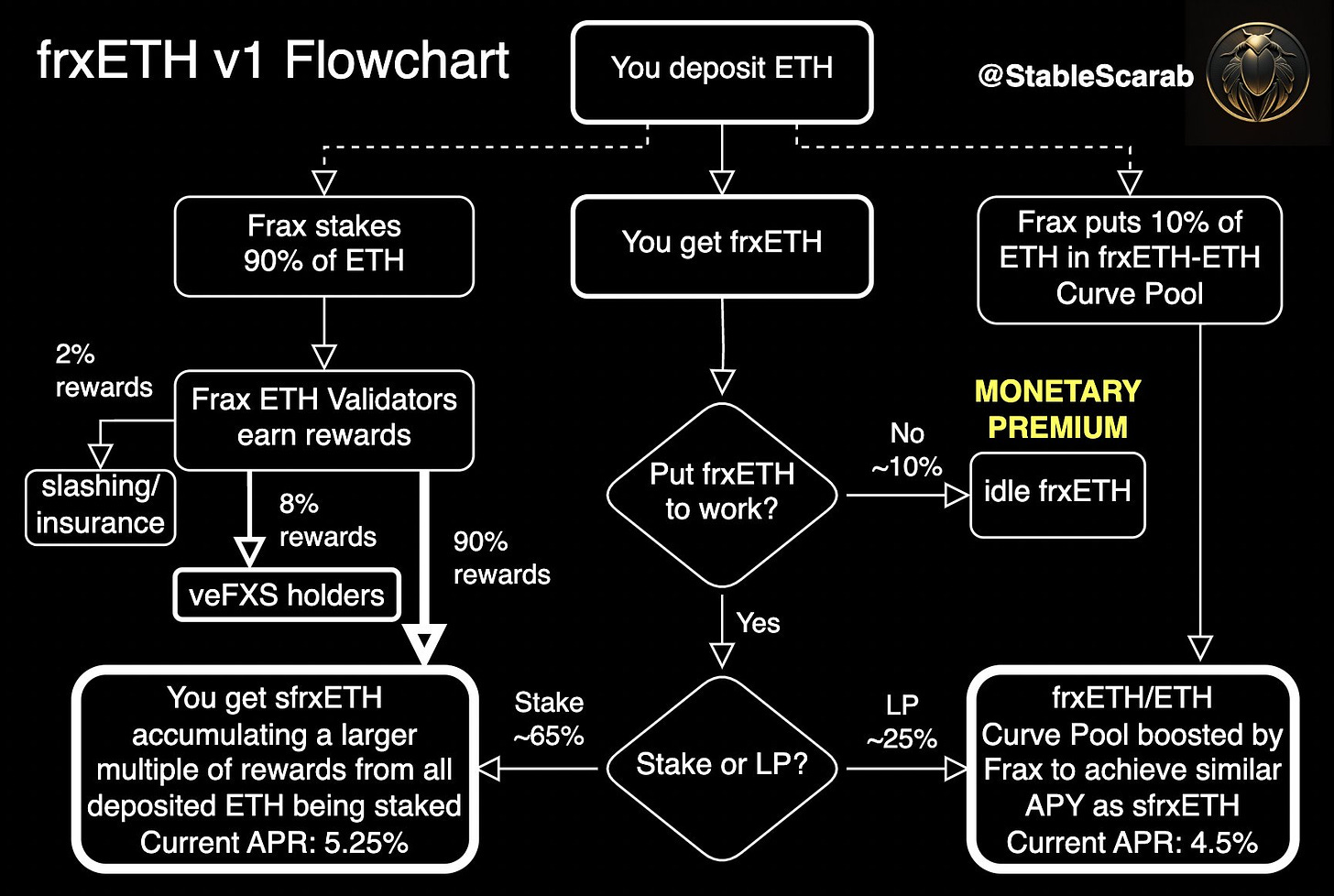

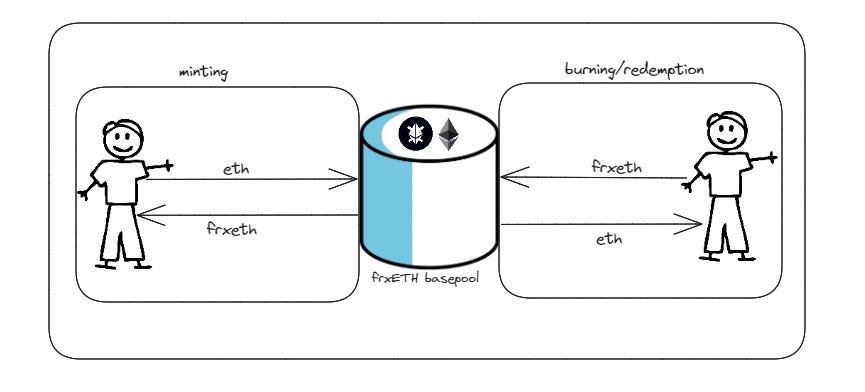

Users come to Frax Finance and deposit their $ETH to earn those juicy $ETH yields. Frax Finance then issues a proportionate amount of $frxETH (for example, deposit 3 $ETH, get 3 $frxETH) and then stakes that underlying $ETH users deposited on the beacon chain, but instead of letting the rewards accrue back to $frxETH, Frax Finance makes these rewards accrue to $sfrxETH (staked Frax Ether), the token users get when they stake their $frxETH.

I hear you asking what the point of having two tokens is, I mean why can’t rewards just accrue to $frxETH, akin to what Lido or Rocket Pool does?

With this dual-token model, Frax Finance is able to create a monetary premium for $frxETH and allow $sfrxETH to capture that excess yield.

A lot of jargon, I know — so let’s break it down step-by-step.

This flowchart does a good job at that.

It goes like this: deposit $ETH, get $frxETH (which aims to be worth 1 $ETH at all times). Either use this $frxETH like you would use $ETH in DeFi (hold, lend, borrow, collateralize, provide liquidity, etc.) or stake it for $sfrxETH and earn that $ETH yield.

But, two questions arise. First, How does $sfrxETH benefit from $frxETH being used for anything but staking? And second, why would anyone use $frxETH for anything else except staking it?

First and foremost, if not all $frxETH is staked, then $sfrxETH gets a higher yield relative to the prevailing market rate.

For example: let’s say I deposit 1000 $ETH into the Frax Finance protocol and get 1000 $frxETH, but only decide to stake one-third (around 333 $frxETH) for $sfrxETH. That means that while all 1000 $ETH is staked on the beacon chain, only 333 $frxETH tokens that were staked for $sfrxETH receive that yield.

In this example, $frxETH stakers ($sfrxETH holders), get a whopping 3 times the yield on average.

But this begs the second question of why $frxETH, in some instances, would not be staked.

$frxETH essentially aims to be a replacement for $wETH (a wrapper of $ETH backed 1:1 with $ETH, like $frxETH).

$wETH is what you see in liquidity pools and DeFi in general. A common misconception is $ETH is used in DeFi — while in fact, $ETH isn’t an ERC-20 token, making it practically unusable in DeFi.

This is why $wETH rose in popularity — people want to use the strong monetary properties of $ETH in DeFi, but cannot without $wETH.

So $frxETH is essentially $wETH, but why use $frxETH instead of $wETH in liquidity pools and DeFi?

The answer lies within the monetary premium Frax Finance is creating for it.

Remember the Frax basepool (FraxBP) mechanisms wherein metapools with the FraxBP as their pairing received a part of the revenue they created for the protocol?

The same mechanism applies for the frxETH’s basepool.

Let’s say a project that wants to pair their token, $TOKEN, with $ETH and do so with $frxETH’s basepool which is comprised of $frxETH and $wETH — essentially two versions of wrapped $ETH comprise the frxETH basepool.

The consequences of the following are similar to the consequences when a project pairs their token with the FraxBP, as seen below.

Projects that want their token(s) to be paired with $wETH can just pair their token(s) with the $frxETH basepool because $frxETH is de facto $wETH but by pairing with the frxETH basepool, projects deepen the frxETH basepool liquidity, and any swaps done in their pool generate a fee for the underlying basepool, half of which goes to the protocol. Also by pairing with the frxETH basepool they deepen liquidity for it, giving the AMO (more on this below) liberty to mint more $frxETH into the pool without breaking peg but being able to generate more swap fees, emissions from the curve gauge and then sharing the swap fees and emissions that these metapools subsidized (helped create) with them (50%, to be precise).

Positive-sum incentive mechanisms, yet again.

And as the pairing is done with $frxETH, as we explained previously, $sfrxETH will soak up that extra yield, giving Frax’s $ETH LST an edge over the incumbents.

So, in essence, projects pair their tokens with another wrapped $ETH variant, $frxETH, but get extra rewards for doing so, with the only downside being a $frxETH depeg, but due to the $ETH backing on the beacon chain and the operations of the AMO, which will be explained below, this is highly unlikely to materialise.

So, the $frxETH AMO.

It’s very easy to understand if you’ve understood the FraxBP (Curve) AMO that we’ve explained above.

If you haven’t, please watch the video above and re-read the portion of this issue where we talk about it.

But assuming you have understood it, understanding the frxETH AMO isn’t an issue at all — just a few nuances that we’ll cover.

First and foremost, the user deposit flow can be seen in the image above. Furthermore, the $frxETH minted by the AMO that doesn’t break the peg is entered into circulation by being backed or redeemed (exits circulation to be minted again or burned if peg is looking shaky/weak) like depicted below.

That’s essentially what you need to know about the AMO and how it plays into the frxETH basepool.

Before we move on, I also wanted to mention that another way Frax Finance creates a monetary premium for $frxETH and allows $sfrxETH, subsequently, to absorb that excess yield is with its large $CVX position.

Currently, it's using it to direct $CRV emissions to the $frxETH basepool, incentivizing users to mint $frxETH and provide liquidity to earn this yield.

This not only allows $sfrxETH to remain an attractive product due to the outsized yield, but also incentivizes metapools to pair with the frxETH basepool, as liquidity has been deepened for it.

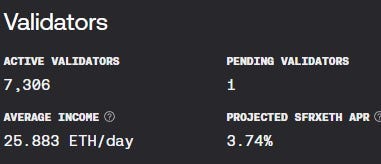

Another thing worth commenting on is Frax Finance’s ability to generate MEV and avoid slashing.

As mentioned previously, staking with LST providers makes sense as they have the infrastructure and technical know-how to do complex things like extract MEV — and this is what Frax Finance excels at.

They’ve never had any incidents of slashing and have been super efficient in extracting MEV, thus driving the highest yield to $sfrxETH holders possible.

This is evident in the effectiveness rating of Frax Finance’s validators on the beacon chain received by Rated Network, an independent third-party specializing in metrics like these, as seen above.

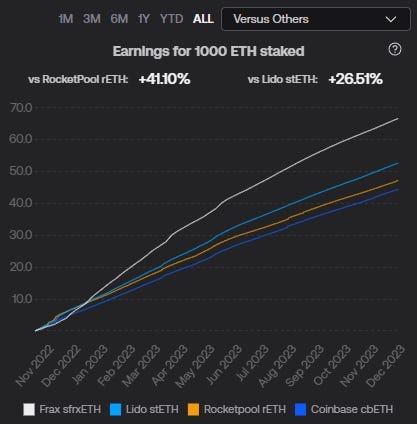

We can see that because of this, as well as the outsized yield $sfrxETH earns because not all $frxETH is staked due to the monetary premium Frax Finance has created for it, $sfrxETH has been earning around 41% more than $rETH (Rocket Pool’s $ETH LST) and 27% more than $wstETH (Lido’s $ETH LST) since inception.

Furthermore, this is only considering the base LST yield from $ETH staking, and disregards the fact that $sfrxETH can be used in DeFi, but, of course, so can $rETH and $wstETH.

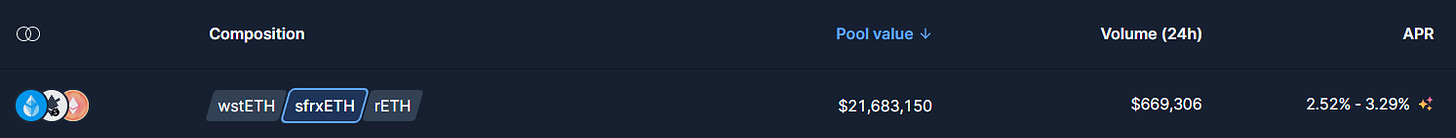

Here’s one of my favorite liquidity pools on Balancer where, on top of the LST yield, you can earn a few hundred basis points for providing liquidity for all 3 of the LSTs we touched on!

You’d think that this would be reflected in the market share of Frax Finance’s $ETH LST.

But you’d be wrong.

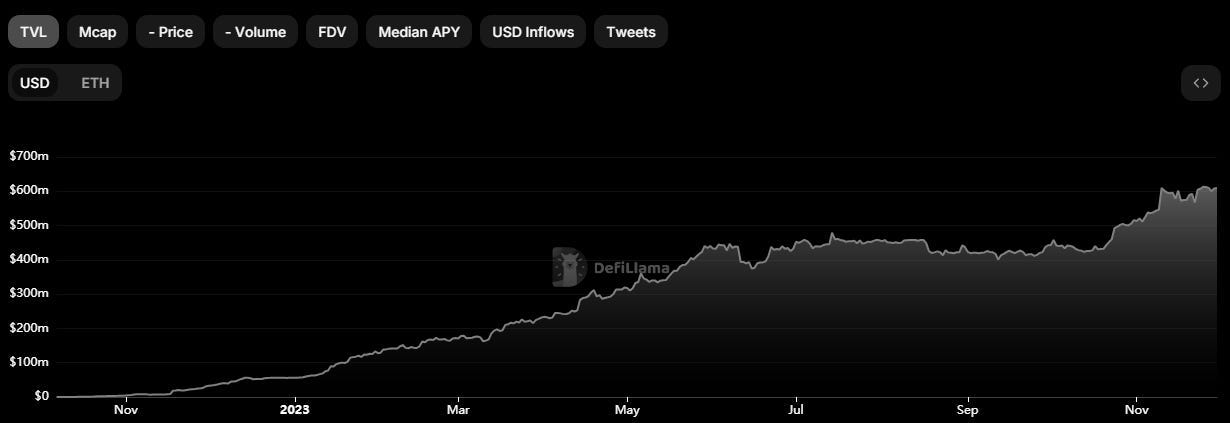

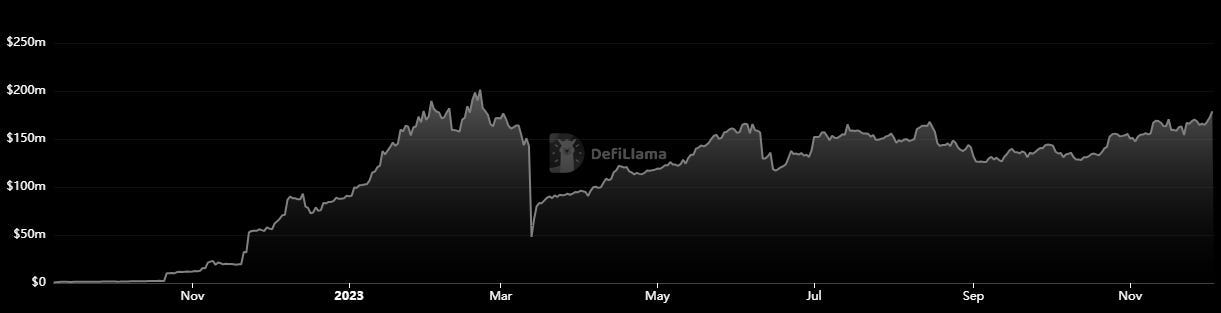

While we can see that the deposits/TVL (total value locked) in Frax Finance’s $ETH LST has been essentially up only, amassing more than $600 million in less than a year, for the kind of product its offering, we believe this is absolutely nothing — a small fraction of what the TVL could be.

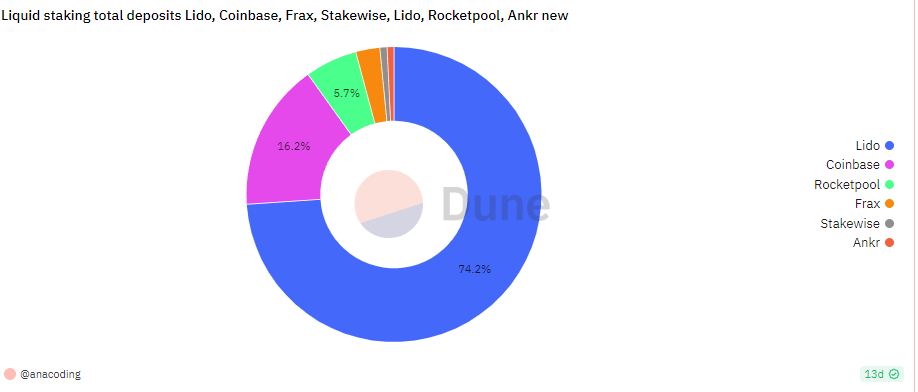

Even in current market conditions Frax Finance’s share of the LST market doesn’t do it justice — it has a mere 2.6% market share of the $ETH LST market at the time of writing, and competitors like Lido, Rocket Pool, and Coinbase, with their inferior products, have magnitudes higher market share.

Considering $frxETH is relatively new, it might take some time for the market to reflect the sheer superiority $frxETH has over its incumbents.

The whole $ETH staking market is small, and as $ETH adoption increases, a significant amount will be staked, probably through LSTs, due to the aforementioned advantages, and considering capital flows to where it is treated best, Frax Finance’s LST is a no brainer.

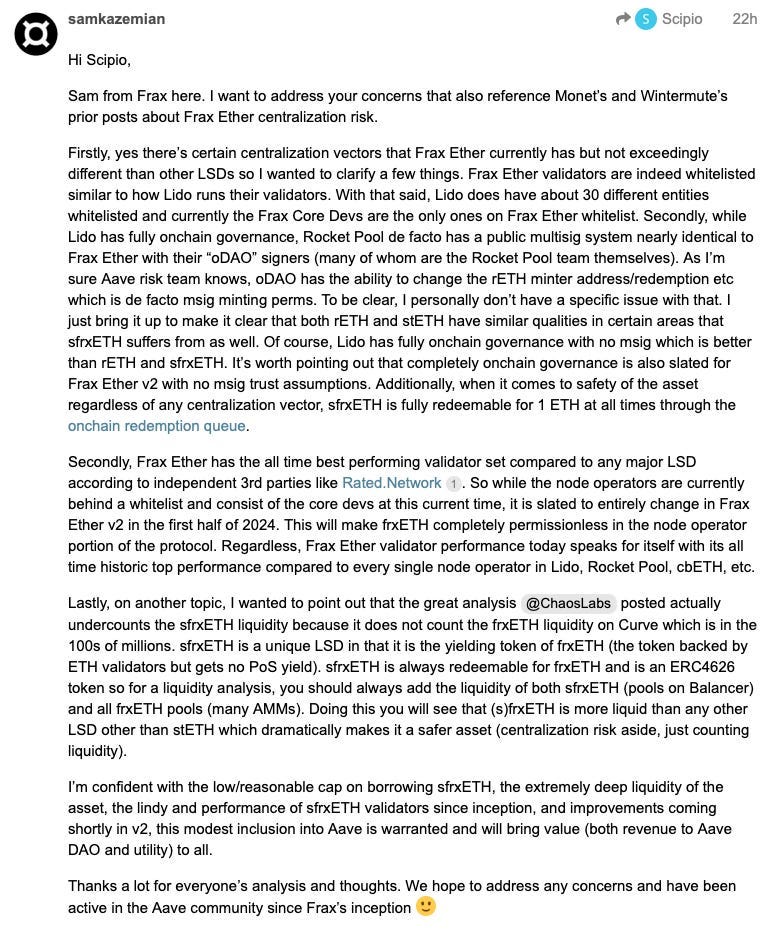

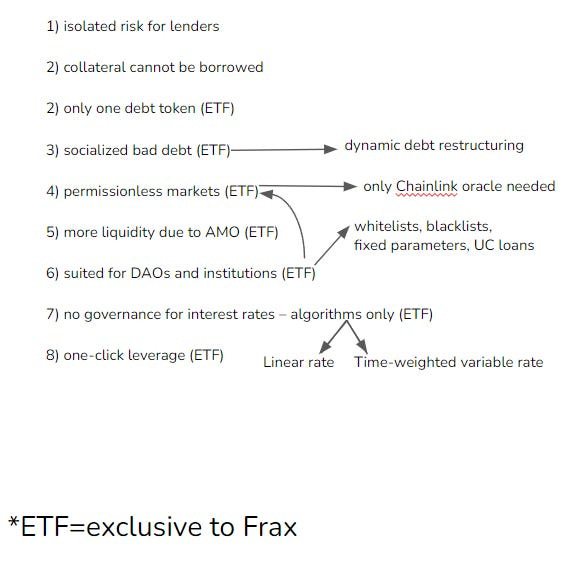

While some attribute the limitations of $frxETH scaling to centralisation concerns, specifically the core team controlling (i.e., running) all validators on the beacon chain, a closer look reveals that even supposedly decentralised players like Lido or Rocket Pool exhibit a high degree of centralisation. Nevertheless, their approach is still more decentralised than Frax Finance's current design. For a more detailed explanation, refer to the linked forum post below.

Now, instead of arguing who is less centralised, Frax Finance’s $frxETH is actually about to undergo a v2 (version 2) upgrade, wherein all the operations of the validator running will be available to anyone, decentralising the protocol and unlocking a plethora of benefits, as seen below.

$frxETH adoption is imminent, don’t you see?

Now, I know this section has a lot to take in.

Some of you might have not understood $ETH staking, the benefits or workings of LSTs, or even $frxETH’s design, AMO, benefits, and v2.

For those of you who fit the bill, I made an hour’s long video breaking down everything in-depth — feel free to check it out below.

The Frax Finance Ecosystem

Before moving onto the part you’ve been waiting for (the investment itself), let’s quickly have a look at the vibrant and innovative ecosystem that Frax Finance boasts to support and accentuate the use cases of its multiple stablecoins that we’ve covered.

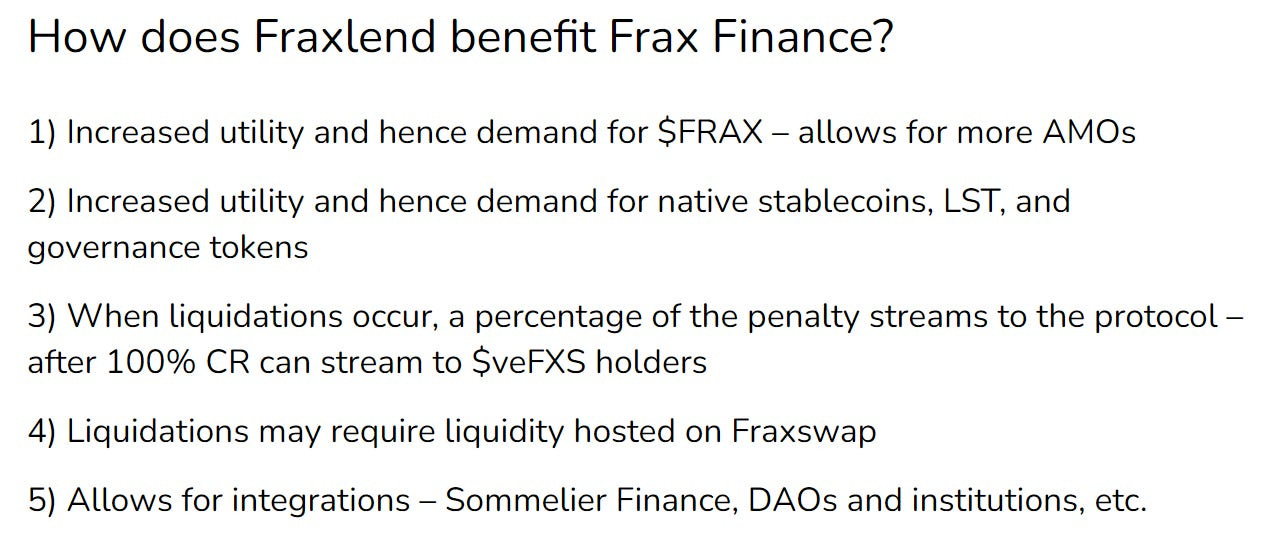

Fraxlend

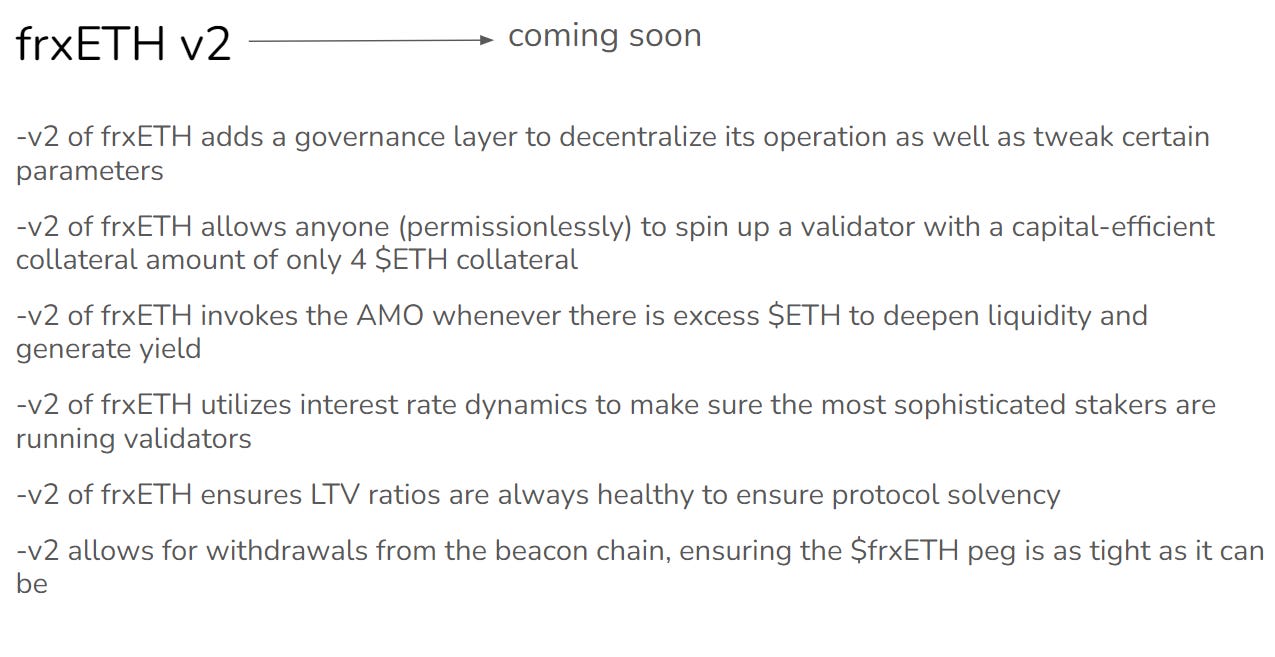

One of the instrumental parts of Frax Finance’s ecosystem is the native (in-house) decentralised money market (lending and borrowing market).

If you do not understand what money markets in DeFi are, we recommend watching the video below.

If you do understand these money markets, you know that they carry with them a lot of risk for lenders, lack of customisability of parameters and markets, and interest rates albeit algorithmic are also controlled by governance.

The recent Curve fiasco exemplifies some of these prevalent issues with money markets like Aave.

You get where I’m going with this — Frax Finance’s native money market solves all these problems.

Even though Fraxlend is instrumental to the ecosystem, it is still an auxiliary part of the Frax Finance offering, so we’re not going to dive deep into it in text format, but we’ve made a comprehensive video that you can find below which breaks it down — we recommend watching it when you have the time.

For those of you in a hurry, find a TL;DR of Fraxlend’s key advantages above.

Fraxlend mainly exists to support the greater stablecoin ecosystem Frax Finance offers, so we can see its current TVL, as seen above, growing in tandem with the adoption of the stablecoins.

It’s not a tiny player either in the money market sector, as seen above.

As for how Frax Finance benefits from Fraxlend, this too can be found in the video we made above, but this is the TL;DR below.

Essentially, Fraxlend increases demand for the stablecoins offered (which as we know by now gives liberty to the AMOs to mint more tokens and generate profits), and generates some revenue from liquidations and the spread between interest paid by borrowers and interest received by lenders.

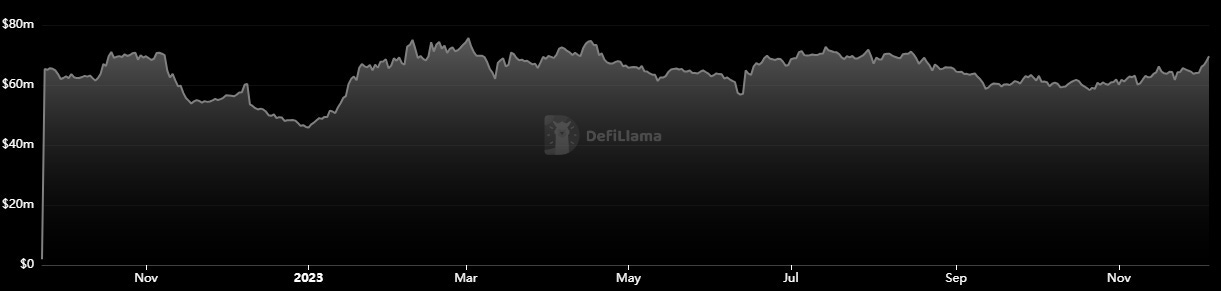

Fraxswap

Fraxswap is the native (in-house) DEX of the Frax Finance protocol, running a constant product AMM (Uniswap v2, essentially).

It only has around $60 million in liquidity hosted, i.e., TVL and like Fraxlend, it mainly exists to support the greater stablecoin ecosystem Frax Finance offers, so we see its current TVL as seen above growing in tandem with the adoption of the stablecoins.

One interesting feature of Fraxswap is the fact that it has a twAMM (time-weighted AMM) built into it — what this means is that large sell or buy orders that would often incur undesirable price impact could be broken up into many smaller sell or buy orders over a period of time, with the end result being more favorable execution.

For example, if I wanted to sell a lot of $ETH tokens that would tank the price if I did sell them all at once, I could specify to Fraxswap that I’ll sell these tokens over the course of 3 months, and Fraxswap would sell these $ETH tokens in increments over the 3 months so that I wouldn’t tank the market, i.e., be exposed to undesirable price execution.

The Fraxswap documentation gives us an insight into the ideal Fraxswap use cases by other protocols, stablecoin issuers, and DAOs.

1) Accumulation of a treasury asset (such as stablecoins) over time by slowly selling governance tokens.

2) Buying back governance tokens slowly over time with DAO revenues & reserves.

3) Acquire another protocol's governance tokens slowly over time with the DAO's own governance tokens (similar to a corporate acquisition/merger but in a permissionless manner).

4) Defending "risk free value" (RFV) for treasury based DAOs such as Olympus, Temple, and various projects where the backing of the governance token is socially or programmatically guaranteed.

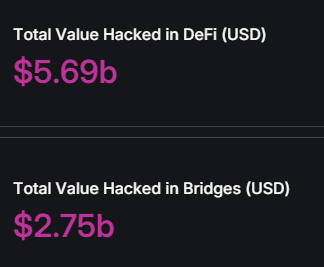

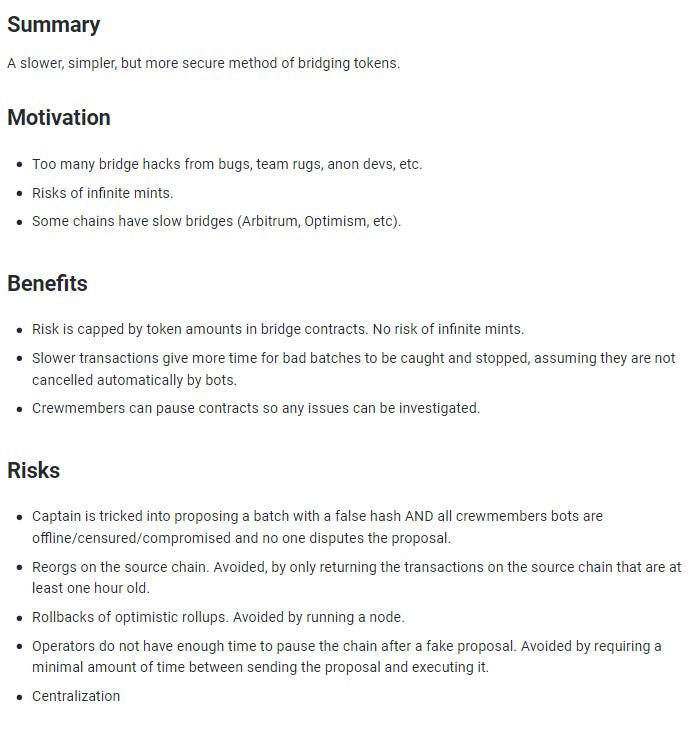

FraxFerry

Fraxferry is the native (in-house) bridge of the Frax Finance protocol, which exists to facilitate the movement of the stablecoins Frax Finance issues to many different blockchains in a safe manner — this last part of safety is essential in DeFi as bridge hacks constitute almost 50% of all hacks in DeFi!

FraxFerry achieves this security through many different mechanisms, but mainly through centralising the Fraxferry protocol.

As seen above, the Fraxferry documentation comes in handy to give an overview of itself.

FrxGov

A common critique of Frax Finance since its inception was its highly centralised nature. From AMOs to the assets owned by the protocol, it was all controlled by a multisig wallet composed of the core team. This meant that the team, albeit doxxed, could rug pull at any time, or even comply with court orders if need be.

This is why frxGov (the Frax Finance governance module) is a breakthrough for the protocol.

FrxGov is a decentralisation upgrade wherein Frax Finance can exist without involvement from the team, which makes it more censorship-resistant — a property we believe all DeFi applications should embody. Namely, frxGov has 3 abilities, all done fully on the blockchain.

Ability to veto any and all proposed transactions by the multi-sig signers.

Ability to replace any and all signers of the multi-sig.

Ability to propose any kind of transaction on AMOs to run the protocol without any multi-sig signers at all.

Currently, however, frxGov is only operational for Fraxlend, and will support the full Frax Finance stack (ecosystem) very soon.

Now, we swear we’ll get to the investment stuff soon! But before that, let’s quickly have a look at what Frax Finance has in the pipeline.

Spoiler alert — it’s bullish.

Fraxchain, FXBs, bAMM

Yes, you read that correctly — Frax Finance is launching its own chain.

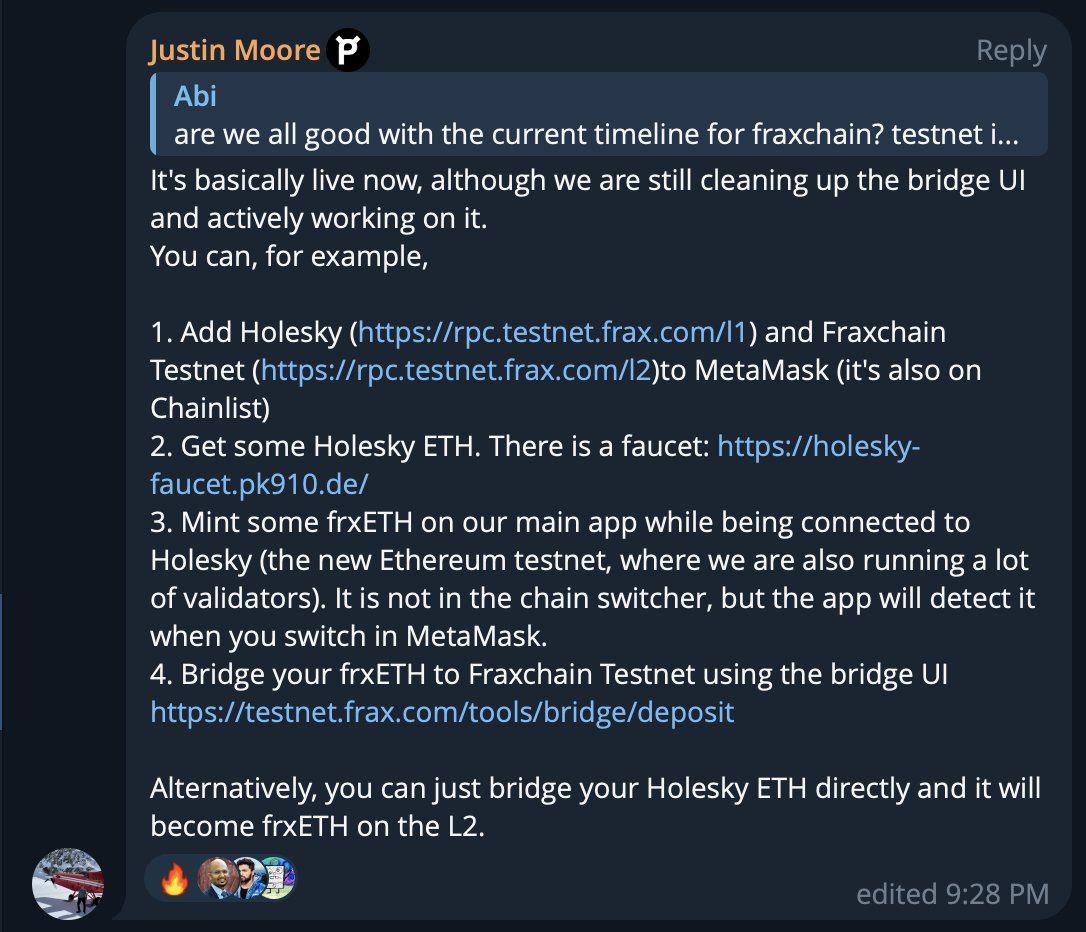

In fact, it’s not even launching its own chain — for Fraxchain is already live on testnet.

But what exactly is Fraxchain, I hear you ask?

While we don’t know all that much about it (we’ve seen the team keep huge things like these under wraps, which aligns with their modus-operandi of under-promising and over-delivering), we do know a few things:

It’s a layer 2 hybrid rollup built on Ethereum — while I wont get into what rollups are and why they’re bullish (since this is something coming up soon 👀), what Fraxchain aims to do is combine the best of, generally speaking, the two most used rollups (for a reason) zk rollups and optimistic rollups — for more info, we recommend reading this.

$frxETH will be used as gas, collateral, liquidity pool pairings, and the unit-of-account throughout DeFi on Fraxchain, furthering $frxETH’s monetary premium (by now we all know why this is bullish).

It will have unique incentive mechanisms to encourage organic usage of the chain.

It will have a bribe-based mechanism wherein sequencers, a vital part of rollups, can be run by anyone provided they place incentives (example in the form of $frxETH) that streams to the protocol.

It will have AA (account abstraction) enabled from day one — arguably what will get crypto to the masses — which will allow for a seamless UX, and hence adoption.

All the stablecoins and products Frax Finance boasts will be deployed onto the chain, but other developers will also have access to incentives to build on Fraxchain.

But that’s not all — in fact, those aren’t even the most bullish things about Fraxchain.

Let me introduce you to the brilliant innovations of FXBs (Frax Bonds) and bAMM (borrow AMM).

While the details for these things too, haven’t been disclosed due to the aforementioned reason, we do know that they’re super bullish (like essentially everything else Frax Finance does).

It’s a way for Frax Finance to not only bring to DeFi an on-chain yield curve, but also an avenue where $sFRAX holders (who are essentially holding claims on real world assets, since as we know the underlying funds are earning the IORB at the Federal Reserve) can access the underlying liquidity at any time (since if a black swan event in crypto happens and even the funds at the federal reserve are safe, people would panic and want instant liquidity, but due to settlement times in TradFi, it might not be possible).

For more information on this, we implore you to watch the video above where the founder of Frax Finance, Sam Kazemian talks about just this.

Now, onto bAMM.

Let’s preface this by saying oracles suck — you’ll know why if you watched the video we made on Fraxlend and isolated money markets (linked below).

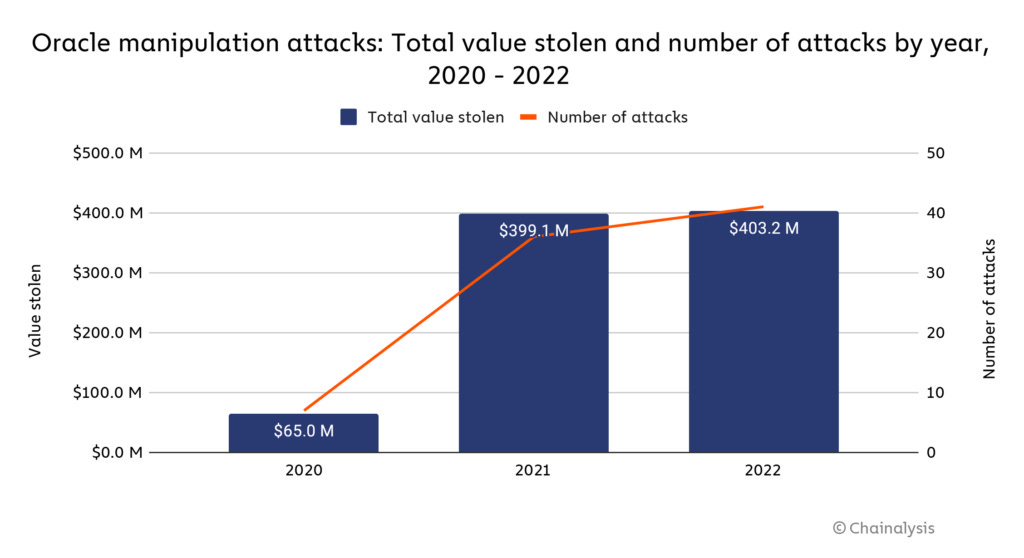

But to be more concrete, oracles get manipulated all the time, just last year alone (2022) around $403.2 million got exploited due to oracle manipulation, and we can see a trend of this increasing, as seen below.

Not just that, but these oracles, which power lending and borrowing in DeFi (among other things), don’t support (i.e., provide price oracles) the long-tail of assets and are also highly centralised.

Case in point: the largest oracle provider, Chainlink, is controlled by a 4-9 multisig — enough said.

Enter bAMM — a primitive releasing soon that allows users to use leverage on any, yes — any, token without the need of oracles — and best of all it’s liquidation free.

More info on bAMM can be found here, here, here, here, and here, but as mentioned, all the details aren’t out yet, and there are obviously many nuances not covered here — but that doesn’t take away from its revolutionary nature.

The thing about bAMM and FXBs (Frax Bonds) is that they are exclusive to Fraxchain — so that in itself is enough to get users onboarded to Fraxchain.

We indeed live in bullish times, and speaking of bullish times, let’s move onto what you’ve been waiting for so long — the investment itself.

But before we do, we humbly ask you to subscribe to our newsletter using the button below. Thanks!

Investment Take

Thus far, you’ve understood what Frax Finance is, what it does, and why what it’s doing is bullish — but how exactly do we act on this information?

Buying $FXS (Frax Shares) is the answer.

It is the token that accrues value from all parts of the ecosystem (products and stablecoins) and governs the protocol (this is the token that powers frxGov) — provided it is locked for $veFXS, a vote-escrow token model that follows the same mechanisms as $veCRV — something you can read about more here and here.

Let’s dive a little deeper into why we believe $FXS can manifest itself to be one of the most lucrative plays for this cycle.

Tokenomics and Fundamental Analysis

Supply-Side Analysis

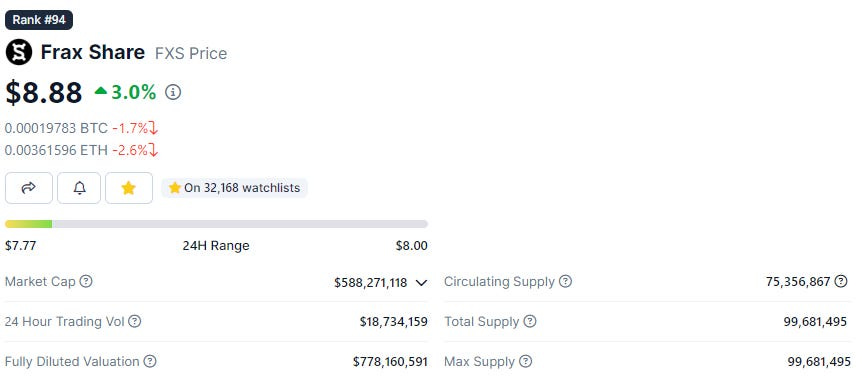

$FXS is currently a low-mid cap altcoin — having only amassed a market capitalisation of $588 million at the time of writing, with a slightly higher FDV (fully diluted valuation) of $778 million (we believe this valuation of $FXS is completely irrational, i.e., undervalued for reasons explained later — but based off of what you have read so far, it might already be obvious).

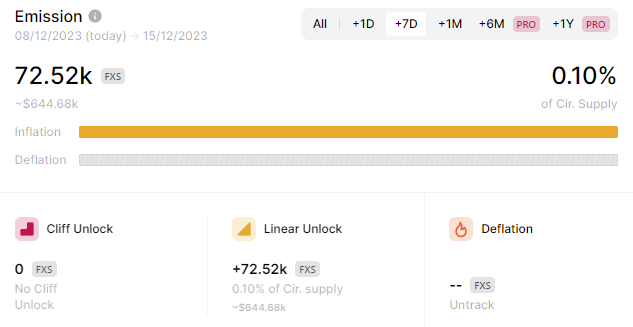

One great thing about $FXS is the fact that current holders (like, for example, you buying $FXS after reading this issue) will get diluted very little, as most of the supply (around 75% at the time of writing) is already circulating.

Furthermore, there are no major unlocks for the token and the supply that is not yet circulating will come into circulation over a long period of time — as seen below (a mere 0.1% of circulating supply comes onto the market daily).

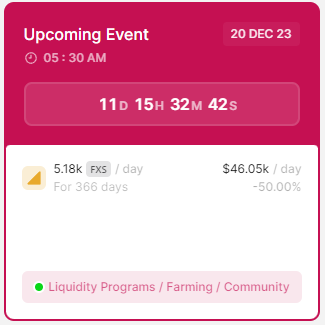

As if that wasn’t appealing enough on the supply-side, this 0.1% of tokens released onto the market every day (relative to circulating supply) will become 0.05% (i.e., a halving of emissions/issuance akin to bitcoin’s halving) as seen below on the December of 20th (around a week from the time of writing).

The only difference between the $FXS halving and bitcoin's is the fact that, albeit emissions/issuance decreases by half, the halving for $FXS happens every year around the 20th of December while bitcoin's happens every 4 years around April.

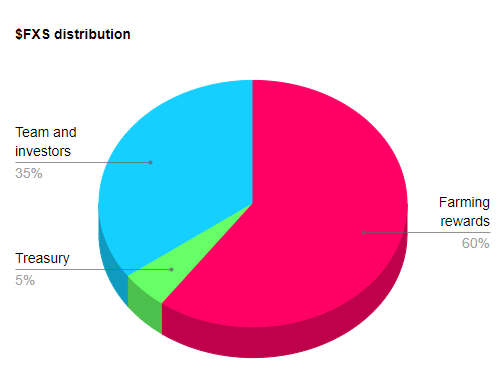

The distribution of the $FXS tokens is the following:

Farming rewards (60%): distribution halving every 12 months (as mentioned above).

Treasury (5%): governed by $FXS lockers (more on this later).

Team and investors (35%): 20% to the team, 3% to advisors and early contributors, and 12% to private investors.

The distribution doesn’t skew too much to insiders and places an emphasis on bootstrapping network effects — a core tenet of any token.

These farming rewards are effectively incentives to provide liquidity for Frax Finance’s stablecoins in its early stages, and as mentioned before, these rewards taper off due to the halving.

This is the de facto design in DeFi as once a token has enough liquidity, trading fees can be enough of an incentive to sustain/retain liquidity providers — I made a video on this topic below too, which I recommend checking out to understand more on this.

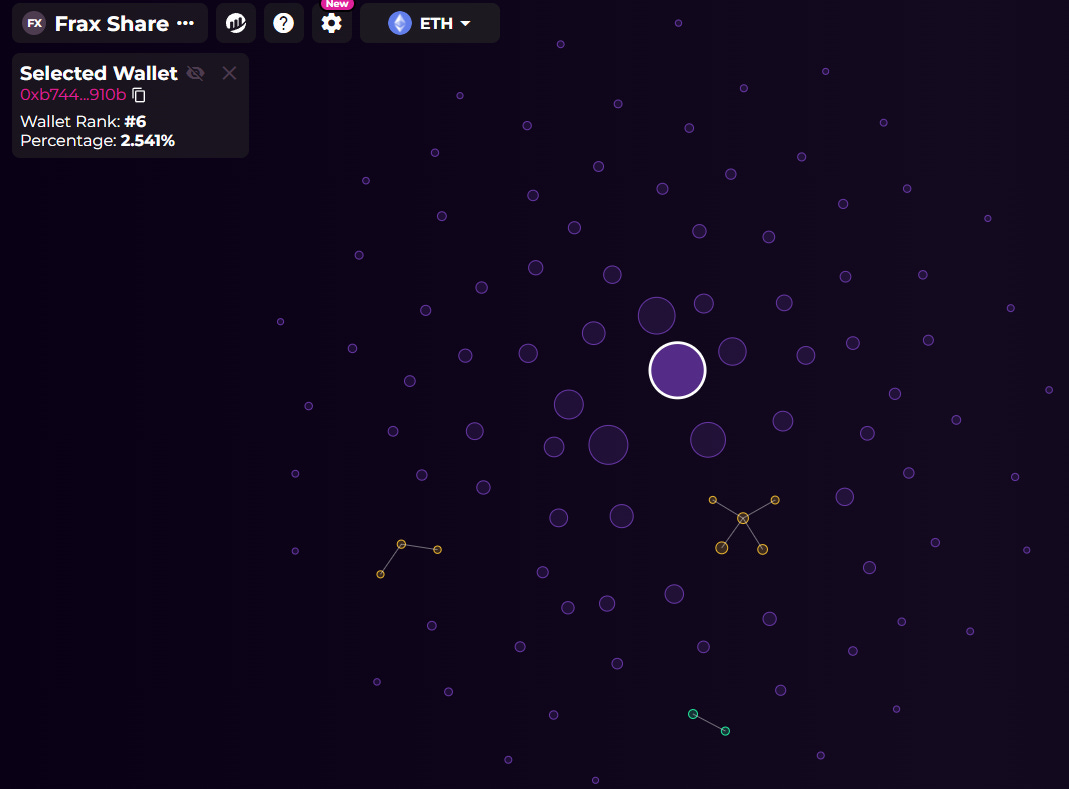

The insider (team and investor) allocation is a little high relative to industry standards, but there’s no point worrying about insiders dumping their tokens after unlocks as all tokens have already been unlocked some time ago and the overall $FXS wallet distribution looks healthy.

The largest holder (non-smart contract holder) of $FXS holds around 2.5% of the circulating supply, as seen below, which not only means that selling from one or a few individuals is unlikely to cause precipitous price drops, but it also signals a level of decentralization that can be commended.

The treasury allocation is straightforward and can’t really result in major dumps since it’s governed by $FXS lockers and is used at their discretion — treasury swaps, grant funding, etc.

The main thing here is that incentives are aligned as $FXS lockers ($veFXS holders) are the only ones who have a say over the use of treasury funds.

On the topic of locked $FXS, i.e., $veFXS, it’s important to note that a whopping half — yes, half — of circulating supply is locked, with around 38% of the total $FXS supply locked and the average lock time being around 2 years — further adding to the solid supply side fundamentals of the $FXS token.

Demand-Side Analysis

Having great products that people use is important, however, as investors, we’re concerned with the upside that this adoption can bring. If the token is properly designed it will reflect said value created by the protocol.

One way to understand if this will happen is by looking at the token demand drivers (i.e., why would a user buy and hold said token).

In the case of $FXS, the relevant demand drivers are:

1) Yield opportunities; the effectiveness of this demand driver depends on the strength of the revenue streams that Frax Finance can create and sustain (discussed later in this issue). However, there are currently a plethora of vectors by which $FXS holders benefit;

All AMO profits ($frxETH and $FRAX AMOs) accrue to $veFXS.

Entirety of the spread on Fraxlend accrues to $veFXS.

A percentage of the liquidation fee/penalty on Fraxlend accrues to $veFXS.

8% of $ETH staking yield accrues to $veFXS.

Revenue generated by Fraxchain/bAMM/FraxFerry/Fraxswap/FXBs/$sFRAX (to be determined).

Two things to note here. First, in order to access this value users have to lock their $FXS thus receiving $veFXS. Second, the aforementioned "value" is distributed to lockers pro-rata via $FXS buybacks — driving buy pressure for $FXS. Furthermore, the $FXS is bought back using Fraxswap — which results in further value accrual.

If you’re interested in learning more about this model's merits and drawbacks, as well as its implications, I wrote a blog post on this, which you can find here.

However, there’s a caveat that needs to be mentioned here. For the longest time, $FRAX was actually a partially-undercollateralized (algorithmic) stablecoin, i.e., it wasn’t fully collateralized like $DAI, $USDC, or $USDT, which allowed it to be more capital efficient and scalable. But after the $UST fiasco mentioned in the former half of this issue, a proposal at the start of this year (2023) was brought forward to bring $FRAX back to 100% collateralization like $USDT and $USDC — increasing the perceived safety of $FRAX, as after the $UST fiasco, no one was touching algorithmic stablecoins — arguably for the better.

So for the entirety of this year, all revenue generated by the protocol was put towards increasing the CR, i.e., collateral ratio (assets on balance sheet divided by the liabilities, i.e., $FRAX in circulation) of $FRAX, which made it go from 80% collateralised at the start of the year to 95.15% currently.

With all the developments coming out of the Frax Finance ecosystem and the revenue generating potential they have (as well as the onset of the bull run), I expect the CR to get to 100% in no time.

But, obviously, this revenue being directed to increasing the collateral ratio had to come at a cost of accruing little value to $FXS, more specifically, $FXS lockers in the short-term — so for the better part of a year, buying and locking $FXS was not very attractive — which reflected in $FXS underperforming the market this year.

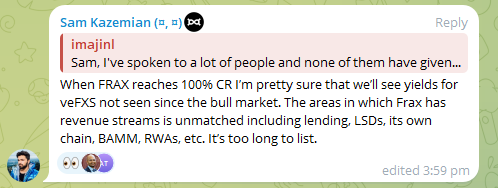

But after the CR gets to a 100%, not only does $FRAX’s scalability constraints get alleviated (which in itself will generate tremendous amount of revenue for the protocol), but all revenue will be directed to $FXS lockers, incentivising the market to take $FXS tokens off the market (buying them) and locking them for a share of the revenue.

Here’s what Sam Kazemian has to say about this.

2) Governance power; The effectiveness of this demand drivers depends on the value of that which can be governed, and that scales with the adoption of the protocol. In the case of $veFXS, emission direction is the main one, as $veFXS has a say (via governance) as to where the emissions of $FXS (farming rewards — the largest $FXS distribution/allocation) go — similar to the Curve gauge model.

Similar to the above, in order to gain governance power and direct emissions, users have to lock their $FXS for $veFXS.

However, this power over directing emissions is more valuable than you think.

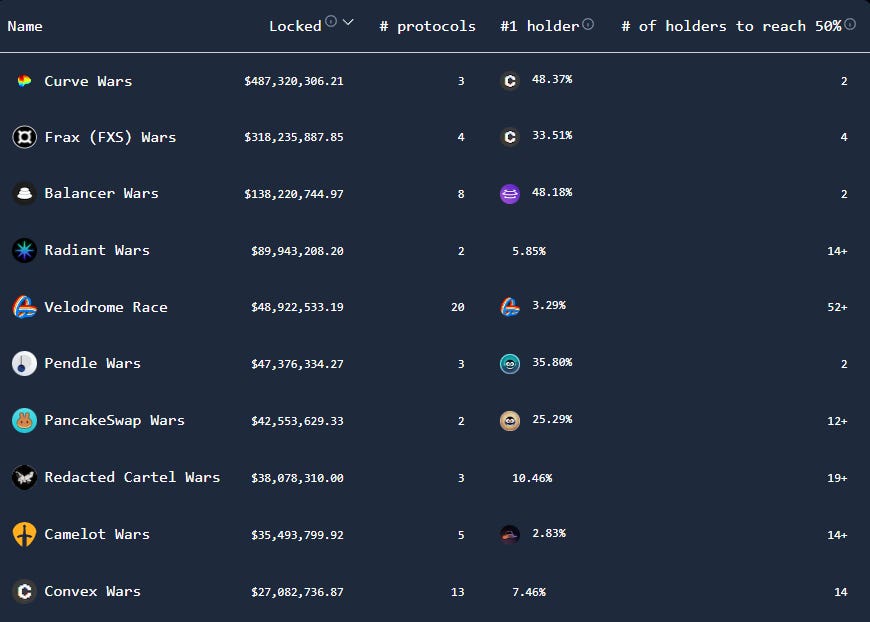

Protocols like Curve Finance, have built multi-billion dollar ecosystems around them (called the Curve wars) due to this exact model wherein lockers of the governance token direct emissions, and Frax Finance is no different

This is because projects who want to deepen their liquidity pools bribe $veFXS holders (like in the Curve wars) to direct $FXS emissions to their pools.

Bribes are placed on an external platform called Hidden Hand, and are a way for $veFXS holders to accrue yield on top of the “native” yield through revenue generated by the protocol.

Furthermore, $veFXS holders who provide liquidity for certain liquidity pools also receive boosted, i.e., extra $FXS farming rewards — another demand driver for $veFXS.

These two things (emission direction and boosted farming rewards) also makes $FXS a desirable asset to accumulate and lock for DAOs looking for perpetual incentives for their pools (to deepen liquidity), and has resulted in a few DAOs already doing so, as seen below!

In fact, the Frax Finance wars are not trailing the Curve wars by all that much, as seen above.

Clearly, governance in the context of Frax Finance is quite the demand driver.

3) Speculative investment vehicle; this applies to all tokens but is worth mentioning.

Before moving onto the next section, let’s recapitulate the demand drivers for $FXS.

The first being the Curve-esque locking mechanism for $FXS which grants revenue share and governance rights provided $FXS is taken off the market (bought) and locked. The second being the $FXS market buyback conducted with revenues generated by the protocol, thus whenever there is revenue there is inherent demand.

Growth and Adoption

Now that we understand how $FXS benefits from Frax Finance’s growth and adoption, let's look at some of these growth and adoption metrics to get an idea of what Frax Finance is currently doing and is capable of doing in the future.

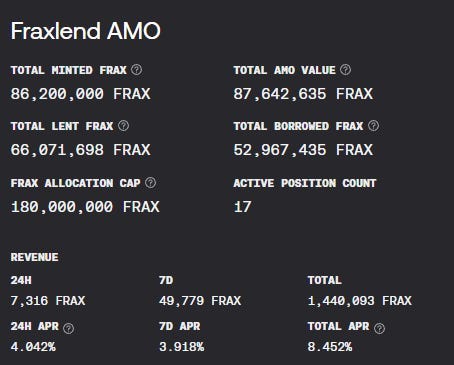

On the Fraxlend side of things, Frax Finance is generating around $50,000 in revenue every week currently (through AMOs, as explained previously), which annualizes to be around $600,000.

This revenue excludes the spread (difference between interest paid by borrowers and interest received by lenders) accrued by the protocol and also the take rate on the liquidation penalty — currently, this revenue isn’t very high, but during the bull run when risk appetite, and thus leverage, is high and many people take on debt (and, subsequently, many get liquidated) this additional revenue from Fraxlend will be substantial.

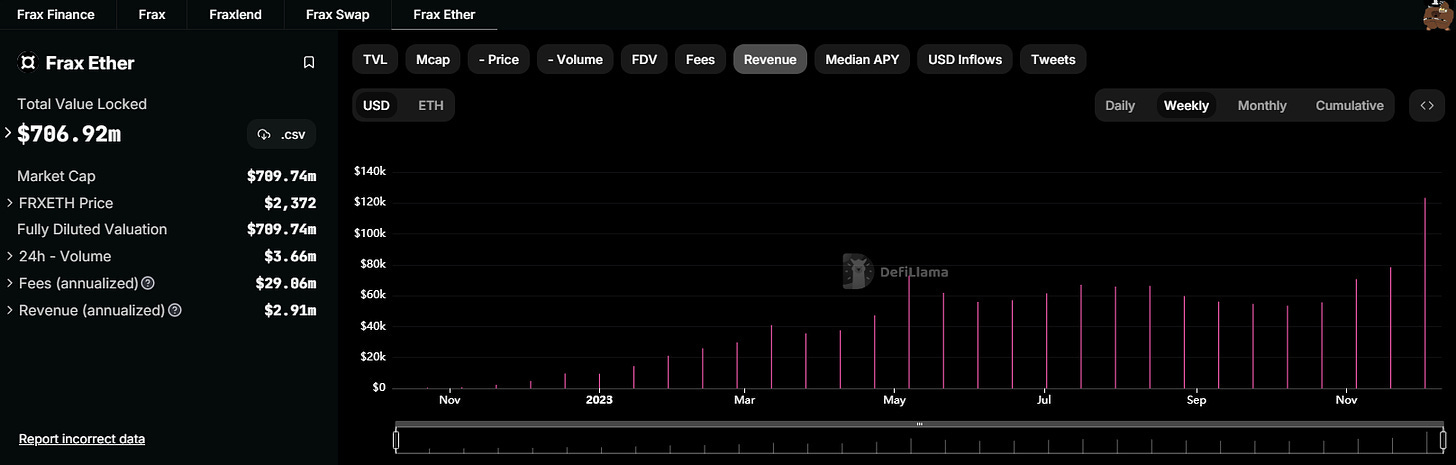

On the $frxETH side of things, Frax Finance is generating around $123,000 in revenue every month currently (through the 8% take rate on $ETH staking yield), which annualises to be around $1.5 million, as seen below.

Our bull thesis for $frxETH, by this point, should be clear and I can say with relative confidence that $frxETH can generate multiples more in revenue as we progress through the bull run and $ETH staking becomes that much more appealing to institutions and retail alike — who will flock to $frxETH to get the best yields and decentralisation.

Furthermore, these $frxETH calculations exclude revenue from AMOs — whilst currently this revenue isn’t that high, using the aforementioned logic for Fraxlend (i.e., in a bull run and risk-on environment) as well as the fact that frxETH basepool integrations will only increase, we can say it will do many multiples later on in the cycle.

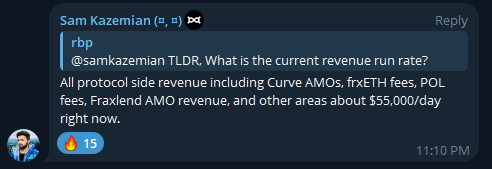

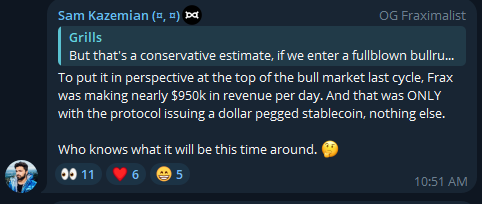

We haven’t touched on individual AMO revenues, but overall, all protocol side revenue including Curve AMOs, frxETH fees, protocol owned liquidity (POL) fees, Fraxlend AMO revenue, and other areas are about $55,000/day right now.

Therefore, at the time of writing, Frax Finance’s revenue run rate is around $20 million — and don’t forget that this is in a bear market/onset of a bull market!

To put it in perspective, at the peak of the bull run last cycle, Frax was generating nearly $950k in revenue per day. And that was only with the protocol issuing a dollar-pegged stablecoin ($FRAX) and nothing else. This annualized to be around $350 million dollars in revenue a year.

That should tell you everything you need to know — just imagine how much revenue Frax Finance will be generating this cycle with all the new stablecoins, Fraxchain, new products, partnerships, and innovation.

All sources referred to in the analysis above can be found here and here.

As a side note, where else can you get verifiable, updated by-the-second financial statements? Only in crypto is the answer.

As trading volume, prices, and basepool integrations (Frax basepool and frxETH basepool) increase manyfold, all AMO revenue will see increases of many multiples.

Parts of the Frax Finance ecosystem (products like Fraxswap, Fraxferry, and others) currently don’t generate any revenue, as Frax Finance’s core objective right now is to grow the protocol and establish network effects — but the scope to monetise them is there and can be done later.

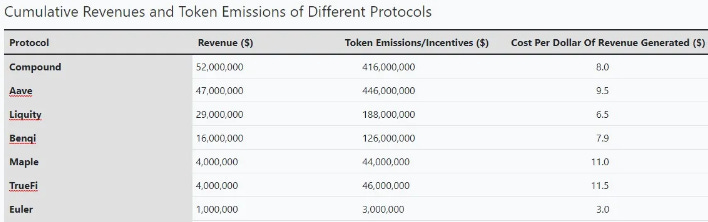

Most of the DeFi protocols today, albeit, to some extent, technology startups like Frax Finance focus on growth objectives rather than profitability ones — I mean after all, the cryptocurrency industry is very nascent too — so expecting profitability already doesn’t make too much sense.

Just look at the image below — like a lot of technology startups, a lot of the biggest DeFi protocols are highly unprofitable, but again, their objectives are growth oriented like most startups.

However Frax Finance, albeit a startup which is growing tremendously, is already profitable!

After the halving we discussed previously, the Frax Finance protocol will be emitting around $46,000 worth of $FXS tokens daily (at current prices), but remember — the protocol is generating $55,000 of revenue daily!

Just imagine how profitable Frax Finance will be as it matures and the industry gets mass adoption — it’s shocking how few people realise the potential of Frax Finance — both as a product and an investment.

Based on current run rate (in the bear market) and locking levels, $FXS holders who lock their tokens for 2 years — the average lock time currently (holders can lock up to 4 years, with higher lock times being entitled to a larger share of the rewards, akin to the $veCRV model) can get an estimated 6-7% APR — not bad, considering it's all real yield (i.e., all revenue generated by the protocol and no token emissions) and in a bear market/onset of a bull market.

One word — bullish.

It’s also worth noting that $FXS holders don’t even need to lock their tokens in order to tap into this yield.

Liquid wrappers which you can read about here and here have been built for $veFXS — allowing users to be liquid while accruing $veFXS yield.

Convex Finance and StakeDAO are currently the two biggest providers of $veFXS liquid wrappers, and other liquid wrappers can be found here.

These liquid wrappers essentially allow for locking to be more appealing to everyone, but on the backend, the $FXS is still locked.

Looking forward, FraxFerry and Fraxswap, as mentioned previously, currently don’t generate any revenue (for reasons explained already).

When a 100% CR is reached, governance can decide to monetise these products and allow the value to accrue to $veFXS.

$sFRAX also follows a similar logic wherein it exists to drive more demand for $FRAX, which will accrue value indirectly to $veFXS by accentuating the amount of revenue that can be generated by AMOs, but governance can always decide to take a cut from the yield accruing to $sFRAX and direct it to $veFXS.

FXBs and bAMM (which have not yet launched) will accrue value indirectly by also accentuating the amount of revenue that can be generated by AMOs (like $sFRAX) upon launching, and governance can also monetise these down the line.

Monetising Fraxchain, which we’ve already covered, is more straightforward and will likely accrue the most value to $veFXS.

Heaps of potential to say the least.

But What’s it Worth?

While we believe that the cryptocurrency industry is too small for quantitative investing metrics to arbitrate investing decisions (we recommend you read our “about” page on Substack to understand our thesis here) since crypto is going to disrupt many verticals in Web 2.0 and reinvent money as we know it today, we still think a rudimentary paper napkin “valuation” should be carried out to get a rough idea of what the upside of $FXS can be.

Here goes:

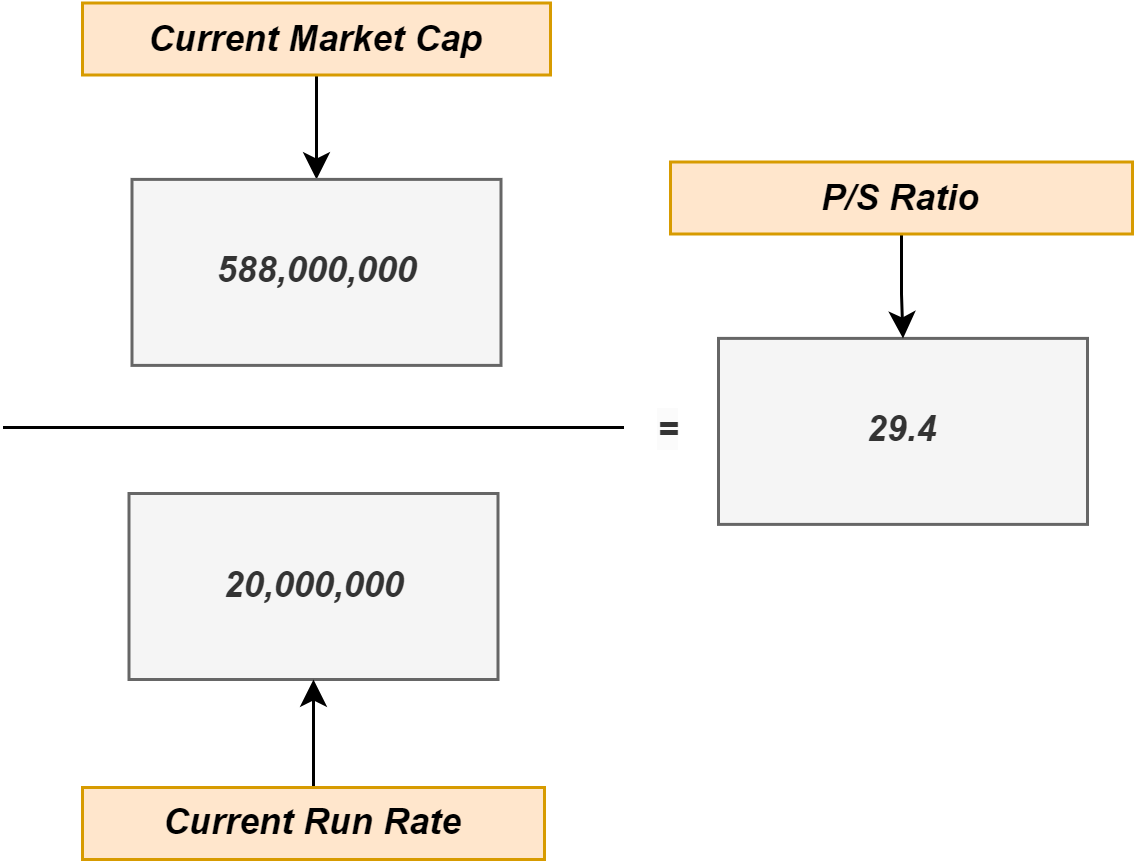

Using the aforementioned $20 million run rate and $FXS’s market capitalisation of $588 million, it puts $FXS at a P/S of 29.4.

This is relatively high, but normal for a technology startup in a nascent industry (DeFi), where in fact the median P/S is 35.6.

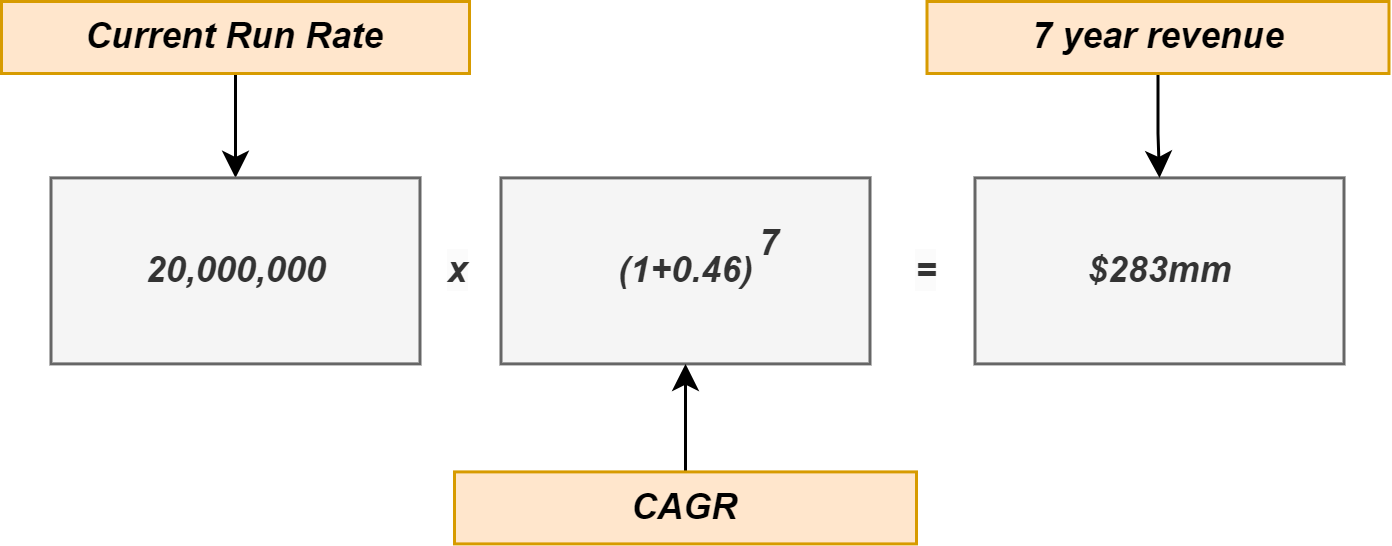

Furthermore, let’s say Frax Finance grows its annualised revenue at the same rate of DeFi’s expected CAGR of 46.0% from 2023 to 2030 — which I’d say is a very conservative estimate.

Then, using this CAGR and the current annualised revenue numbers for Frax Finance, we can calculate the revenue in 7 years.

At $FXS’s current P/S multiple this gives us a market capitalisation of around $8.3 billion, in order words, a 14.12x from its current prices at the time of writing ($8.88 to a whopping $125.4).

Talk about a moonbag!

A more short-medium term valuation can be found when comparing the current market capitalisations of $FXS and Lido’s native token (the issuer of $wstETH we talked at length above) $LDO — 3.22x is the upside $FXS has in the short-medium term (around 2 years) if it can reach $LDO’s level as seen above.

Even $FXS reaching its previous highs of $42.80 will result in around a 5x from current levels!

And keep in mind that Frax Finance at its previous highs near the end of January 2022, was a very nascent protocol without a lot of developments that makes it such a strong player in the DeFi landscape today.

For those of you who want a little more math for the valuations we’re coming to, here you go.

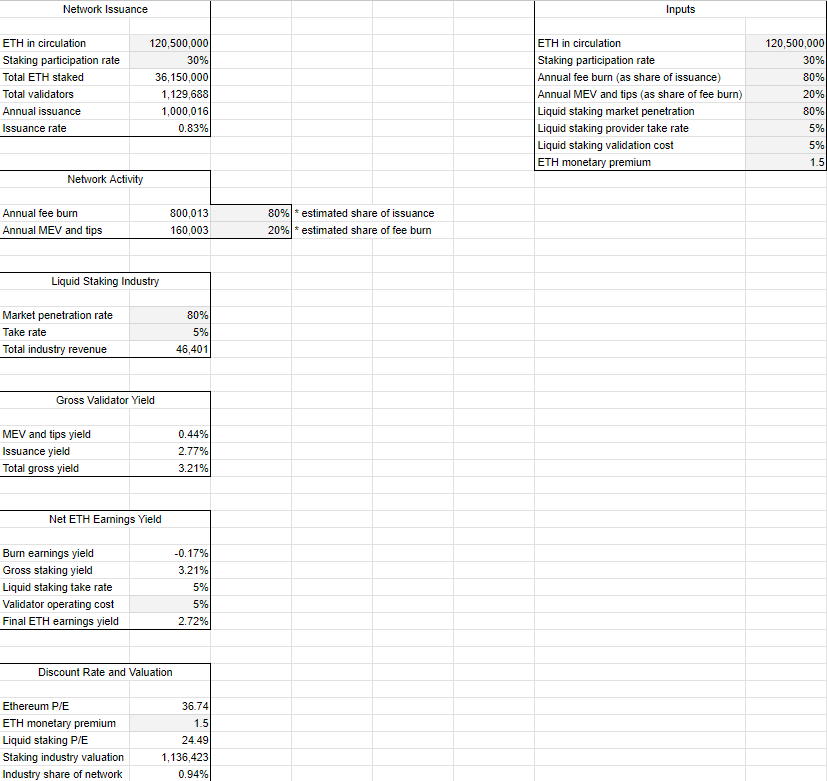

Using the spreadsheet above made by Monet Supply from Block Analitica (a risk intelligence company whom we hold in high regard for DeFi), with relatively conservative estimates (30% of circulating $ETH will be staked to the beacon chain; 80% of that $ETH will be staked through LST providers like Frax Finance and Lido; these LST providers take a 5% cut), we come to value the LST industry at 1,136,423 $ETH or around $2.7 billion (this valuation takes into consideration that $ETH itself will be more valuable than the LST industry by a significant factor due to its money properties, i.e., monetary premium).

Currently, around 24% of all $ETH in circulation is staked, with only half of the current stake going through LST providers.

One of the reasons only 24% of all $ETH is staked is because Ethereum only recently migrated to PoS and even more recently enabled people to withdraw their $ETH from the beacon chain. ~imajinl, earlier in this issue

Considering $ETH will do many multiples in the coming cycles and accrue stronger network effects and a monetary premium, we can reasonably assume the LST industry will grow in tandem.

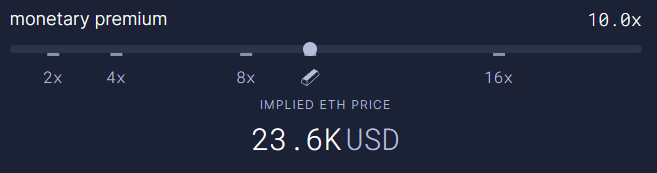

For example, $ETH with a monetary premium of gold will price $ETH 10x from current prices, as seen above.

This will value the LST industry at around a reasonable $27 billion.

And with Frax Finance’s $ETH LST’s current market share of 2.6%, this increases $FXS’s market capitalisation from $588 million to $702,000,000 million, around 1.2x — a measly amount.

But we’re not investing in something if we believe its market share (in this case Frax Finance’s share of the LST market) will stay constant or increase marginally.

As you probably have already grasped, Frax Finance’s LST will grow its market share by many multiples. A reasonable and relatively conservative assumption is that it’ll get to 30% of the $ETH LST market share, which will put $FXS’s market capitalisation to $8.1 billion, around a 14x from current prices — and this is disregarding all other parts of the Frax Finance stack (other stablecoins, products, Fraxchain, etc.).

As already mentioned, we anticipate there to be huge demand for $ETH staking (institutions, etc.) and, due to aforementioned benefits of LSTs, Frax Finance’s LST in particular.

There’s also a huge demand for U.S. dollar stablecoins in third-world countries and countries with capital controls and oppressive governments, and $FRAX as well as the broader Frax Finance ecosystem will be there to meet those demands, not to mention being one of the only stablecoins (with $sFRAX) to bring off-chain yields on-chain!

Of course, a lot of assumptions have been made and these are obviously rudimentary paper napkin valuations, but it should give you some idea as to the sheer magnitude of upside potential $FXS has.

Outlook

Look — there’s no denying it — we’re super bullish on the future of Frax Finance and $FXS.

The team has constantly innovated (and is showing no signs of stopping) and persevered through this brutal bear market.

I can write many paragraphs about the education, experience, etc. of the Frax Finance team, but actions speak louder than words — and plus, the team is not omnipotent in the context of the protocol, as with frxGov the power and the future of the protocol is in the hands of $veFXS holders, arguably the stakeholder with the most vested interest in seeing the project succeed.

Frax Finance has an immense amount of economic tailwinds going for it, from $ETH becoming increasingly adopted to growing dominance of U.S. dollars in the global economy and the high interest rate environment we live in. But arguably the most impressive and important thing about Frax Finance is its ability to thrive in any economic condition — dollar collapsing? No problem. Dollar inflating away? No problem. High interest rate environment? No problem. Low interest rate environment? No problem. It’s a true all-weather stablecoin protocol that can capitalise on any economic condition and create a monetary premium for its stablecoins (through all the mechanisms we’ve gone over).

It also has a multitude of catalysts that can drive a lot of demand for $FXS — Fraxchain, the move to 100% CR, the expansion of frxGov to include the larger Frax Finance stack, FXBs, frxETH v2, the $FXS halving, and bAMM to name a few. And these aren’t just any catalysts, for these are catalysts that could prove to be pivotal in the mass adoption of Frax Finance’s stablecoins and broader ecosystem.

There are also some other catalysts that we haven’t mentioned. First and foremost, the Frax Finance team is in the process of getting a master account at the Federal Reserve — which will not only increase the scope of yield that can be generated for $sFRAX, but also decrease dependence on $USDC, which comprises most of $FRAX’s backing, i.e., collateral at the time of writing. Furthermore, the team is also working on $frxBTC, yet another stablecoin that they want to create a monetary premium for. Considering $BTC DeFi on the Ethereum blockchain isn’t very prevalent, it might be a good niche to conquer. Last but not least, it’s basically confirmed that the team is in touch with PayPal and its novel U.S. dollar stablecoin $PYUSD to form a partnership that will deepen liquidity for $PYUSD on-chain through the Frax basepool. Imagine the half a billion active PayPal users who will be using $PYUSD under the hood (it is likely that the fact they’re using blockchain technology will be abstracted away from them) and benefiting Frax Finance in the process — that alone would be enough to take Frax Finance to the next level. This isn’t the only basepool partnership though, with many others being established with formidable players like Paxos.

But as we know, Frax Finance has established positive-sum mechanics that don’t require partnerships to be formed for basepools to be utilised, which is why there are dozens of projects out there who utilise the Frax basepool without permissions or forming inroads with the Frax Finance team — this is just one of the reasons why Frax Finance will benefit greatly if DeFi gets adopted, as it’s essentially at the core of it!

Also remember, Frax Finance happens to be the largest holder of $CVX and a huge holder of $CRV too — the two projects at the core of on-chain liquidity, and the fact that $FRAX (more specifically, $sFRAX) is one of the only stablecoins capable of capturing significant market share from dominant stablecoins like $USDC and $USDT (who do not share any yield with holders) is extremely bullish.

The sheer amount of value accrual to $veFXS after 100% CR is what will bring retail and even institutions back into $FXS, but that won’t happen overnight, so until then, DCA into $FXS or just use one tranche to acquire a position because after all, time in the market beats timing the market — especially true in an asset class like crypto.

Overall, $FXS has great demand and supply-side fundamentals, and is laying the groundwork for the paradigm shift into decentralised finance. It has already built up a mighty ecosystem, as seen below, that will prove to be pivotal in the advancement of the industry as a whole.

Profit from the U.S. dollar’s power in the short-term and when the dollar, like its other fiat counterparts, eventually collapses, profit off the future of money.

Actions to take:

Buy $FXS on CoW Swap (but only if you’re on the Ethereum blockchain; if not, find the exchanges you can buy on for other blockchains here).

Stake your $FXS tokens on Convex to remain liquid while accruing a yield (currently around 8% APR, but it will be multiples higher once the bull market is in full effect and $FRAX gets to a 100% CR).

We hope you enjoyed the first issue of the Luminous Ledger Newsletter!

If you liked what you read and want to be notified of future free issues, consider becoming a free subscriber using the button below!

Disclaimer: this newsletter, Luminous Ledger Newsletter, contains information pertaining only to educational content. The information is not advice and should not be treated as advice. You must not rely on the information in the newsletter as an alternative to legal, financial, or tax advice from an appropriately licensed professional. If you have any specific questions about any such matter, you should consult an appropriately licensed professional. Whilst we endeavour to ensure that the information in the newsletter is correct, we do not warrant or represent its completeness or accuracy. We will not be held liable for any decisions you decide to make as the consumer of this content.